In Summary

- Africa’s furniture industry in 2025 is booming, driven by urbanization, a rising middle class, and demand for locally made products.

- Top African-owned companies like Pepkor Holdings, Taeillo, and Latex Foam lead through innovation, digital retail, and large-scale production.

- These firms boost employment, sustainability, and global recognition of Africa’s design and manufacturing excellence.

Deep Dive!!

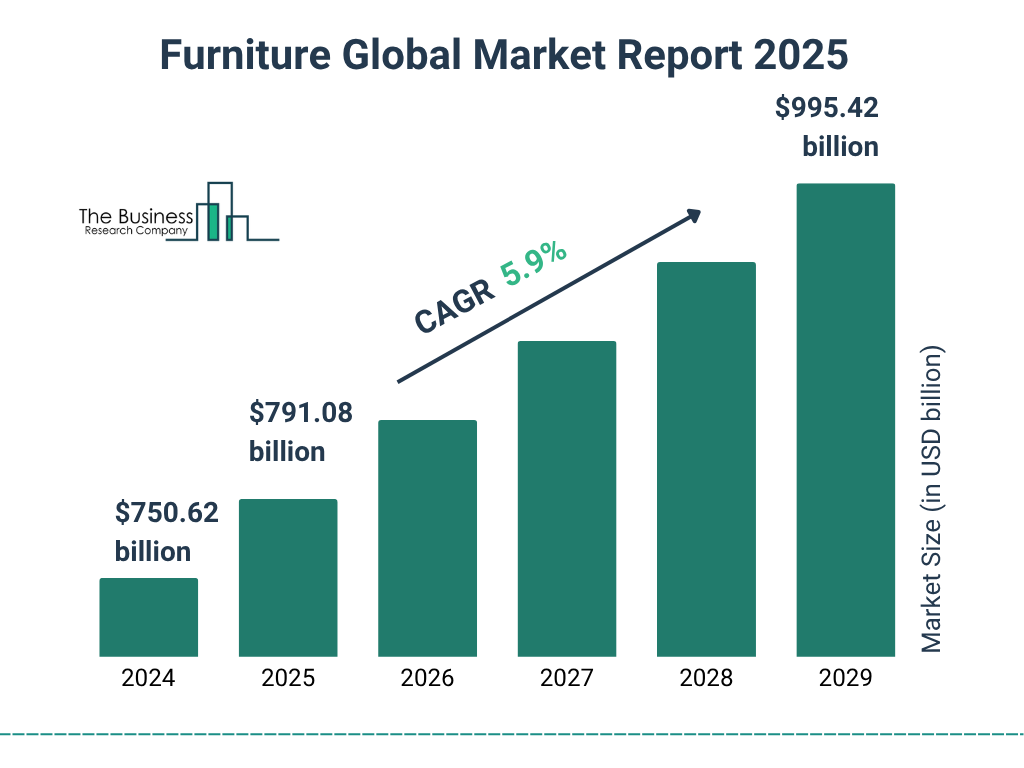

Africa’s furniture industry in 2025 stands as a dynamic reflection of the continent’s economic growth, creativity, and manufacturing resilience. With rapid urbanization, a rising middle class, and renewed interest in locally made products, African-owned furniture companies are redefining modern living spaces. These enterprises combine craftsmanship with innovation, leveraging technology, sustainable sourcing, and culturally rooted designs that resonate both locally and globally. The furniture market in Africa, valued at over $20 billion in 2024, continues to attract investment from domestic and international players, yet African-founded firms are increasingly setting the pace.

The Top 10 Furniture Companies in Africa in 2025 highlights a mix of legacy brands and emerging disruptors that together shape the continent’s home and office furniture landscape. Established manufacturers such as Pepkor Holdings and Latex Foam anchor the industry through large-scale production and retail networks, while rising brands like Taeillo (Nigeria) and Me&Co (South Africa) are leveraging e-commerce and digital design tools to reach new markets. These companies not only provide essential household and commercial solutions but also contribute significantly to employment, with many operating large factories and employing hundreds to thousands of workers across multiple African regions.

Beyond their economic contributions, these companies embody Africa’s growing commitment to sustainable design and industrial self-sufficiency. Many are increasingly adopting circular production models, using locally sourced materials, and developing products that balance aesthetic appeal with affordability. Together, the top furniture companies of 2025 reflect a continent confidently asserting its place in global design and manufacturing, proving that “Made in Africa” furniture can compete on quality, scale, and innovation.

10. Taeillo (Nigeria)

Taeillo was founded in 2018 in Lagos, Nigeria by entrepreneur Jumoke Dada. Its mission is to deliver African-inspired furniture designs using modern e-commerce methods and tech (such as augmented reality / virtual reality tools) to enhance customer experience. The company is privately held and headquartered in Ikeja, Lagos.

Since its founding, Taeillo has raised approximately $3 million over several funding rounds. A notable round was in December 2022, when it secured $2.5 million in seed funding from Aruwa Capital Management, to scale operations particularly within Nigeria and expand into East Africa. Earlier, it had received bridge and pre-seed funding from investors such as Co-Creation Hub (CcHub) and others. The company operates in both online (direct e-commerce) and showroom/physical display channels to reach its customers.

Taeillo is modest in size compared to large legacy furniture firms; as per its LinkedIn company profile, it has 51-200 employees. Its product portfolio includes living room couches, Afro-urban furniture, lighting & décor, with specialties in “ready-to-assemble” furniture and items designed to reflect African aesthetics. The company also emphasizes environmental consciousness in its processes, including zero-waste design ambitions and sourcing materials responsibly.

Taeillo’s strategy places a strong emphasis on scalability, cost control, and design innovation—using tech (e.g. AR/VR) to differentiate its customer experience. The recent investment has been earmarked for increasing production capacity, improving delivery infrastructure, and expanding its product lines.

Among the challenges are competition from both low-cost imported furniture, fluctuations in raw material costs, and logistical issues across Nigeria. Looking ahead, Taeillo is positioned to deepen its footprint not just in Nigeria but in East Africa, continue leveraging technology, and aim for more affordable, quality furniture solutions in the mass market.

9. Chagoury Group (Nigeria)

Chagoury Group is a Nigerian multinational conglomerate founded in 1971 by brothers Gilbert R. Chagoury and Ronald Chagoury. The group is headquartered in Lagos, Nigeria, and operates primarily in Nigeria and West Africa. Its portfolio spans multiple sectors including construction, real estate, hospitality, flour milling, glass, water bottling, telecommunications, insurance, and notably for this profile, furniture manufacturing through its Silhouette Furniture subsidiary.

Silhouette Furniture is the Chagoury Group’s furniture‐manufacturing arm. Its factory is located in Port Harcourt, Nigeria, where it produces both home and office furniture. Products under the Silhouette brand are used by other Chagoury companies, for hotels (e.g. Eko Hotel & Suites in Lagos, Hotel Presidential in Port Harcourt, Metropolitan Hotel in Calabar) as well as for external customers. The company has been undergoing restructuring and re‐equipment of its Port Harcourt facility.

While exact numbers for Silhouette’s furniture workforce are not published as of mid-2025, the Chagoury Group as a whole employs tens of thousands of people across its divisions. The furniture division is notable for recent investments: Silhouette’s Port Harcourt factory is being re-equipped with “state of the art machinery,” and new product lines are in planning. There is also a strategic push to expand showrooms and to scale its bespoke furniture offerings for contractors.

They currently focuses primarily on the Nigerian market, though Chagoury reports that a “full export drive” is being planned towards neighbouring West African countries. Publicly disclosed revenue figures specific to Silhouette are limited; the Chagoury Group’s overall net worth and business valuations are substantial (Gilbert Chagoury has been cited among Nigeria’s wealthy businesspersons with diversified holdings), but furniture revenue is not broken out in depth in most reports. Key challenges for the furniture division include competition from cheaper imports, the cost of modernizing equipment, and logistics/supply chain constraints. Still, Silhouette’s upgrading of facilities and product line expansion indicate a commitment to scale and quality improvement.

8. That Couch Place (South Africa)

That Couch Place was established in 2010 and is based in Pretoria, Gauteng Province, South Africa. The business is privately owned, local, and primarily serves customers in Gauteng, although it also accepts orders from further afield with transport arrangements. The company operates a showroom in Pretoria where customers can view its lounge, bedroom, dining, mattress, and bed furniture offerings.

That Couch Place manufactures a wide range of furniture: lounge suites, couches, sofas, dining sets, beds, and mattresses. Approximately 70% of its product line is manufactured in house, while 90% of all products are locally manufactured in South Africa, reflecting a strong emphasis on local production and reducing reliance on imports. The products cater both to wholesalers and direct retail customers, with pricing focused on being high-quality yet affordable.

Specific recent data on That Couch Place’s staff numbers and revenue isn’t publicly available as of mid-2025. What is known is that it is a relatively small to mid-sized operation with local production capacity sufficient to support its showroom operations in Pretoria and fulfil orders both within Gauteng and in some cases further out. The business model combines online and physical showroom sales, which helps with customer reach and engagement without needing a very large footprint.

Strategically, That Couch Place has invested heavily in in-house production and local supply chain. The high percentages of local manufacture (70–90%) suggest investments in tooling, workshops, and sourcing of materials. This helps control costs, improve lead times, and appeal to customers seeking locally-made furniture. However, the lack of published financials suggests some constraints with scale: challenges likely include managing raw-material price fluctuations, labour and utility costs, and competing with cheaper imports. The showroom-plus-online model helps buffer some of these pressures. Going forward, That Couch Place seems positioned to deepen its local production, possibly expand its showroom presence, and strengthen its logistics capability to serve customers outside its immediate region more efficiently.

7. Aristocraft Furniture Manufacture (South Africa)

Aristocraft is a South African furniture manufacturer based in Pretoria, Gauteng Province. The company is led by CEO Faizel Motani, who emphasizes high-quality design, craftsmanship, and local manufacture. The business prides itself on being wholly local, serving South African retailers and high-end customers with luxury and everyday furniture designs while employing local artisans and manufacturers.

Aristocraft produces a wide array of furniture pieces: bedroom suites, dining room suites, lounge furniture, chairs, headboards, coffee tables, plasma units, and bespoke custom orders. The company offers both upholstered and wooden furniture, and its design language leans toward clean modern lines, combining sleek materials with durable construction. The factory is world-class, with an emphasis on using quality raw materials and precision manufacturing processes.

Aristocraft reportedly employs over 100 people, which includes manufacturing, upholstery, design, administrative staff, and sales. While this is modest compared to large mass-market furniture companies, it is consistent with its focus on precision, lower-volume luxury manufacture rather than mass output. The company emphasises efficiency, quality control, waste minimisation, and workflow optimisation. Its reputation is built on craftsmanship and consistent on-time delivery.

While specific revenue figures for 2024/2025 are not publicly disclosed for Aristocraft, its positioning is clearly towards the more premium segment of the South African furniture market. It invests in design, quality raw materials, and brand aesthetic to differentiate itself in a marketplace with strong competition from cheaper imports and mass producers. Key challenges include sourcing raw materials at reasonable cost, managing manufacturing costs, and delivering luxury/fashionable design while maintaining local value. Going forward, Aristocraft’s growth likely depends on further automation, maybe expanding export or boutique retailer channels, and reinforcing its identity as luxury and designer furniture within South Africa’s growing high-end furniture demand.

6. Fine Wood Works Ltd (Kenya)

Fine Wood Works Ltd is a privately held Kenyan furniture manufacturer, wholly owned and managed by Kenyans. Originally founded in 1943, the company has its roots along Racecourse Road in Nairobi but later relocated to a site off Homabay Road, off Enterprise Road, where its main factory and showroom are now located. The company has built its reputation in high-end woodworking, residential fit-outs, and manufacture of both wood and metallic furniture.

Fine Wood Works designs and produces a diverse array of products for residential, hospitality, and commercial / corporate clients. Their product line includes custom wardrobes, kitchen units, TV stands, sofas, tables, commercial reception counters, and metallic furnitures, among others. Their factory is strategically sited in Nairobi, and they also operate an ultra-modern showroom where clients can view samples of furniture, cabinetry, and raw materials. They use a mixture of imported hardwoods (e.g. Teak, Mahogany, Mango, Meru Oak, Mvuli) and high-quality imported finishing materials (German accessories, Italian and Dutch varnishes) to ensure durability and finish.

While precise current employee numbers are not disclosed, Fine Wood Works stresses that it has a “well-experienced team” and have invested heavily over decades in skilled labour and craftsmanship. The company also invests in machinery and processing tools that enable design flexibility and efficiency, allowing complex custom furniture and quicker turnaround times. Their facility is outfitted with modern woodworking equipment to process a variety of designs, joinery techniques, and finishes. There is also an emphasis on the showroom infrastructure, which has been upgraded to display product ranges and raw materials choices to customers.

Fine Wood Works has maintained a strategy of combining local craftsmanship with high-quality imported raw materials and finishing components. This gives them a positioning in the premium / boutique furniture segment in Kenya and neighbouring markets. However, challenges persist: imported raw materials (especially hardwoods and finishing accessories) subject them to foreign-exchange risk and supply chain delays. There is also pressure on production costs due to utilities, labour, and transport. Despite these, the company has built trust among large corporate clients and in the hospitality sector, which provides stability. Looking ahead, Fine Wood Works is likely to continue investing in both machinery upgrades and expanding its showroom or client outreach, possibly increasing custom contracts and fit-outs as Kenya’s real estate and hospitality sectors grow.

5. Latex Foam Rubber Products Ltd. (Ghana)

Latex Foam Rubber Products Ltd. was founded on 8 March 1969 by Aid Solomon Laba and Nowfill Solomon Laba, Ghanaian entrepreneurs of Lebanese origin. From its start, the company aimed to manufacture foam products for mattresses and furniture, and it inaugurated using Dunlop-licensed technology to give its early products a quality edge. The company remains privately owned by the Laba family.

Latex Foam is headquartered in Accra (North Industrial Area, Kaneshie) with its main factory and head office there, and a second production facility in Kumasi (Kaase Industrial Area). The company also established factories or subsidiaries in other West African countries, notably Niger and Burkina Faso in the early 2000s, to serve regional demand. The product range is substantial: spring mattresses, foam mattresses, sofa beds, pillows, bedding accessories, upholstery items, student mattresses, therapeutic products and other furniture-adjacent items. Latex Foam is considered a leading manufacturer of polyurethane flexible foam and spring mattresses in Ghana and West Africa, with its “Honeymoon Mattress” among its most well-known brands.

Latex Foam’s staff strength is estimated between 500-1000 employees per its profile and directory listings. It sells throughout Ghana and exports to several neighbouring countries including Togo, Burkina Faso, Mali, Ivory Coast, and Benin. Exact recent revenue figures are not published publicly in 2024/2025, but directory sources suggest annual turnover could be within tens of millions of USD (depending on market conditions). The company has won multiple awards recently, including the Ghana Foam and Mattress Business Pride Award 2025 for being a leading manufacturer and brand in quality foam products in Ghana and West Africa.

Latex Foam continues to invest in innovation: over the decades it has introduced new technologies such as spring mattresses (since early 1970s), high-density foam, nested and pocket-spring mattress designs, ultra-flex resilient foams, and memory foam (“visco-elastic foams”) to its product portfolio. The company has expanded its physical footprint and showrooms, depots in regional capitals, and restructured its factory spaces (with the main factory in Accra now covering some 200,000 sq ft of facilities including factory + head office.Challenges include raw-material import dependency (for chemicals, polyols, specialty items), cost of utilities, and competition from both regional producers and imported foam/furniture products. Looking forward, Latex Foam aims to scale its export markets further, deepen local content, and continue upgrading its production quality and designs to maintain leadership in West Africa.

4. Me & Co (South Africa)

Me&co (styled “me&co Furniture”) is a South African furniture company founded in 1995 by Johan and Quinta Dercksen in the town of Graaff-Reinet in the Eastern Cape. Initially known as “Melamine Corner,” it began as a small family business, with just a few craftsmen in a 500 m² workspace making melamine furniture. Over nearly 30 years, me&co has grown significantly while retaining its local roots and commitment to South African design and manufacturing.

By 2024/2025 me&co operates out of a 4,600 m² factory and warehouse in Graaff-Reinet and employs around 100 people across manufacturing, design, administration, and retail support functions. The company produces over 70,000 furniture pieces annually, a mix of flat-pack and pre-assembled furniture items. Monthly production was estimated at about 6,000 units of flatpack furniture per month, which roughly translates to 72,000 per year; other preassembled lines complement that volume.

Me&co’s product range includes bedroom, living room, office, and decorative furniture, along with storage, shelving, wardrobe units, coffee tables, and TV stands. All products are 100% locally designed and manufactured in South Africa, with raw materials and hardware sourced from within the country wherever possible. Their furniture is offered through both their own direct channels and via over 40-110 retailers/stockists nationwide. This widespread retail footprint helps ensure that their affordable, design-led furniture is accessible across most provinces.

Me&co’s strategy emphasizes affordability, scalable flatpack formats, and design appeal that suits local aesthetics and functional needs. Its investment has primarily gone into scaling manufacturing capacity (factory upgrades, optimizing workspace), enhancing design innovation, and maintaining a workforce with design, assembly, and customer-service skills. Because of its local supply chains, me&co is relatively less exposed to import delays and foreign exchange shocks compared to companies that heavily depend on imported furniture. However, the challenges include maintaining cost competitiveness with cheaper imported alternatives, managing raw-material price volatile cycles, and keeping lead times low while ensuring quality. In 2025, me&co appears to be reinforcing its positioning by increasing its stockist network, improving delivery logistics, and investing in customer support and product development to sustain growth.

3. Vava Furniture (Nigeria)

Vava Furniture was founded in 2012 by Egyptian entrepreneur Michael Tawadrous, who also serves as the group’s President & CEO. Based in Nigeria, the company specializes in designing, importing, manufacturing, and retailing furniture across a wide range of categories: living room, bedroom, kitchen & dining, outdoor, office furniture, lamps/lightings, and home décor. Their vision is to become the leading furniture merchant in Nigeria and sub-Saharan Africa through competitive pricing, innovative products, and strong customer service.

Vava employs about 1,334 team members across its operations in Nigeria, combining skilled and semi-skilled labour to deliver its furniture lines. To support this, the company owns “13 ultra-modern 200,000 sq.mt. factories and warehouses” in Bogije, Lagos. Production is significant: they produce and retail over 35,000 finished furniture units annually in Nigeria alone. As of 2024, Vava has established 16 showroom locations across the country, covering major states like Lagos, Oyo, Kano, Rivers, and Abuja.

While precise revenue figures are not publicly published, all indicators suggest strong growth and market presence. Vava is repeatedly nominated for “Best Furniture Company in Nigeria” by BusinessDay newspaper, signaling strong brand recognition. Michael Tawadrous has emphasized local production and cost competitiveness as strategic pillars, especially amid fluctuating economic conditions, high import competition, and supply chain challenges. The company has managed to increase local content in its raw materials to over 70%, which helps reduce dependency on imports.

Despite its rapid growth, Vava faces challenges common in Nigeria’s manufacturing sector: infrastructure constraints (power, logistics), fluctuating macroeconomic conditions, and import competition. To address these, Vava is investing in local supply chains, enhancing internal workforce training, and scaling up factory and showroom footprints; for example, by targeting five additional showroom outlets by end of 2024. There is also evidence that Vava is broadening its brand into real estate (flagship mixed‐use or residential developments) and engaging in diversified business lines under the Vava Group umbrella.

2. Coricraft (South Africa)

Coricraft is a South African furniture and home‐furnishings retailer and manufacturer, originally part of Tapestry Home Brands. In 2022, Tapestry (which owns Coricraft, Dial-a-Bed, Volpes, The Bed Store) was acquired by The Foschini Group (TFG) for approximately R2.35 billion. The company is headquartered in South Africa and operates primarily in South Africa, Namibia, and Botswana. Its leadership includes Kevin Utian (CEO of Tapestry / Coricraft group) under the broader management of TFG.

Coricraft is known for manufacturing and retailing couches, bedroom, and living room furniture, along with bedding and home textiles through its affiliated brands (Dial-a-Bed for mattresses, Volpes for linen & curtains). It has multiple manufacturing facilities, factories in Cape Town, Johannesburg, and Port Elizabeth, and a large number of stores (roughly 175 stores across South Africa, Namibia, and Botswana) under its portfolio.

While detailed recent revenue for Coricraft alone is not always publicly isolated, its business (within the Tapestry / TFG “Home & Lifestyle” cluster) contributes significantly to TFG’s turnover. The Tapestry group employs around 2,500 people, and its locally manufactured products account for about 47% of net sales. Recent improvements have included sourcing more raw materials locally, improving productivity, efficiency, and performing lean manufacturing transformations at its Cape Town facility.

A major strategic initiative for Coricraft in 2024-25 has been its localisation effort: shifting product lines formerly imported into local production, especially at its Epping facility. This localisation was backed by the Localisation Support Fund (LSF), which has enabled Coricraft to replace tens of millions of rand in imports, support over 500 jobs, and generate around R80 million in domestic manufacturing value. Lean manufacturing methods (e.g. 5S, workflow standardisation, real-time monitoring) have improved factory performance and sewing efficiency (the latter up ~38%) between Q2 2024 and Q2 2025. But challenges remain: cost pressures from inputs, competition from cheaper imports, and managing scale while maintaining quality and lead times in a cash-based retail environment. Coricraft is betting on local supply chain strengthening, efficiencies, and growing its footprint to offset these pressures.

1. Pepkor Holdings (South Africa)

Pepkor Holdings originated as a value-retail group in South Africa and is now one of the country’s major retail holdings. The company is backed by prominent South African investor Christo Wiese, who has been a significant shareholder and figure associated with Pepkor’s growth. Pepkor’s operations fall into several divisions, but for furniture and related home goods, the relevant part is its “Pepkor Lifestyle” division (formerly known as JD Group in that segment), which includes home furniture, appliances, consumer electronics and associated finance offerings.

For the fiscal year ended 30 September 2024, Pepkor reported total group revenue of about R85.1 billion (South African Rand), up ~7.8% year-over-year. Its furniture, appliances & electronics segment (part of Pepkor Lifestyle) contributed around R11.0 billion in revenue. Meanwhile, the clothing & general merchandise segment (CGM) contributed R61.4 billion. For the half-year period ended 31 March 2025, group revenue rose from approximately 12.8% to R48.8 billion, with the furniture/appliances/electronics component seeing about a 9.1% increase.

Pepkor employs approximately 44,200 people across its traditional retail operations, which include its CGM and Pepkor Lifestyle (furniture, home, electronics) businesses, plus about 2,400 employees in its FinTech segment. The Lifestyle division alone (which focuses on furniture, appliances and electronics) operates 906 stores under multiple brand banners (e.g. Russells, Bradlows, Rochester, Sleepmasters, Incredible Connection, HiFi Corp) with a combined trading area of ~395,000 m². In 2024-2025, Pepkor also made a major acquisition: it bought Shoprite’s furniture business for about R3.2 billion (~US$179 million) to deepen its presence in furniture retail across South Africa and other Southern African markets.

In its latest interim report (six months to 31 March 2025), Pepkor’s operating profit rose about 13.3% to R5.8 billion, with strong performance across its retail divisions and growth in its fintech business. The group is targeting expansion of its store network (250-300 new stores by year-end) and is leveraging acquisitions to extend its product offering and geographic reach. The furniture/appliances & electronics segment remains less profitable than the core clothing & general merchandise business, with thinner operating margins and greater sensitivity to cost pressures (import costs, inflation, supply chain challenges). However, Pepkor is pushing to lower these risks via scale, improved sourcing, and expanding its finance offerings to support customer purchases.