As Bitcoin approaches the long-term support level of $25,000, there are speculations about whether the price will hold or experience further decline.

Traders and investors closely monitor the market dynamics to determine the next potential move for the leading cryptocurrency. The price prediction for Bitcoin remains uncertain, as it navigates this critical support level.

Let’s delve into the factors influencing the market sentiment and explore the possibilities for Bitcoin’s future trajectory.

Bitcoin Faces Regulatory Uncertainty and Dollar Strength: Impacts on the Market

Bitcoin is facing increased regulatory uncertainty in the United States, as Marathon Digital, a prominent mining company, has received a subpoena from the SEC.

The investigation aims to determine whether Marathon Digital violated federal securities laws through related-party transactions.

Additionally, concerns arise from the Grayscale GBTC Trust Fund, which holds a substantial amount of Bitcoins and has been trading at a significant discount for over a year.

The parent company, Digital Currency Group (DCG), has faced challenges with failing subsidiaries, including Genesis Capital, which filed for bankruptcy protection.

Amidst these developments, Bitcoin experienced a 7.2% correction while the US dollar showed strength, as indicated by the dollar strength index (DXY).

The inverse correlation between the DXY index and Bitcoin suggests that a stronger dollar affects demand for alternative store-of-value assets.

To gain further insights into the market, let’s examine derivatives metrics and the positioning of professional traders.

Bitcoin Price

The current price of Bitcoin stands at $26,454, with a trading volume of $18.4 billion in the past 24 hours. Bitcoin has experienced over 2.75% decrease in value during this period.

As the leading cryptocurrency, it holds the top position on CoinMarketCap with a live market capitalization of $512 billion.

The circulating supply consists of 19,371,200 BTC coins, while the maximum supply is capped at 21,000,000 BTC coins.

On the technical front, Bitcoin has found support around the $26,300 level after halting its downward trend.

The breach of the $26,800 support level on the four-hourly timeframe now turns it into a potential resistance level for Bitcoin.

Looking at key technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), both are in the oversold zone, indicating that if Bitcoin remains above $26,000, there’s a good chance of a bullish rebound toward $27,800 or $27,500.

However, the 50-day Exponential Moving Average (EMA) also acts as a significant resistance around $27,500, suggesting the bearish bias still persists.

To summarize, watch $26,000 as a crucial pivot point. Bitcoin’s ability to hold above this level may lead to a test of the next resistance levels at $27,500 or $28,400.

In case of a continued downward trend, the next support is likely to be around the 50% Fibonacci retracement level of $25,300.

Buy BTC Now

Top 15 Cryptocurrencies to Watch in 2023

The team at Cryptonews Industry Talk has compiled a selection of highly promising cryptocurrencies for 2023. These cryptocurrencies exhibit significant growth potential in both the short and long term..

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

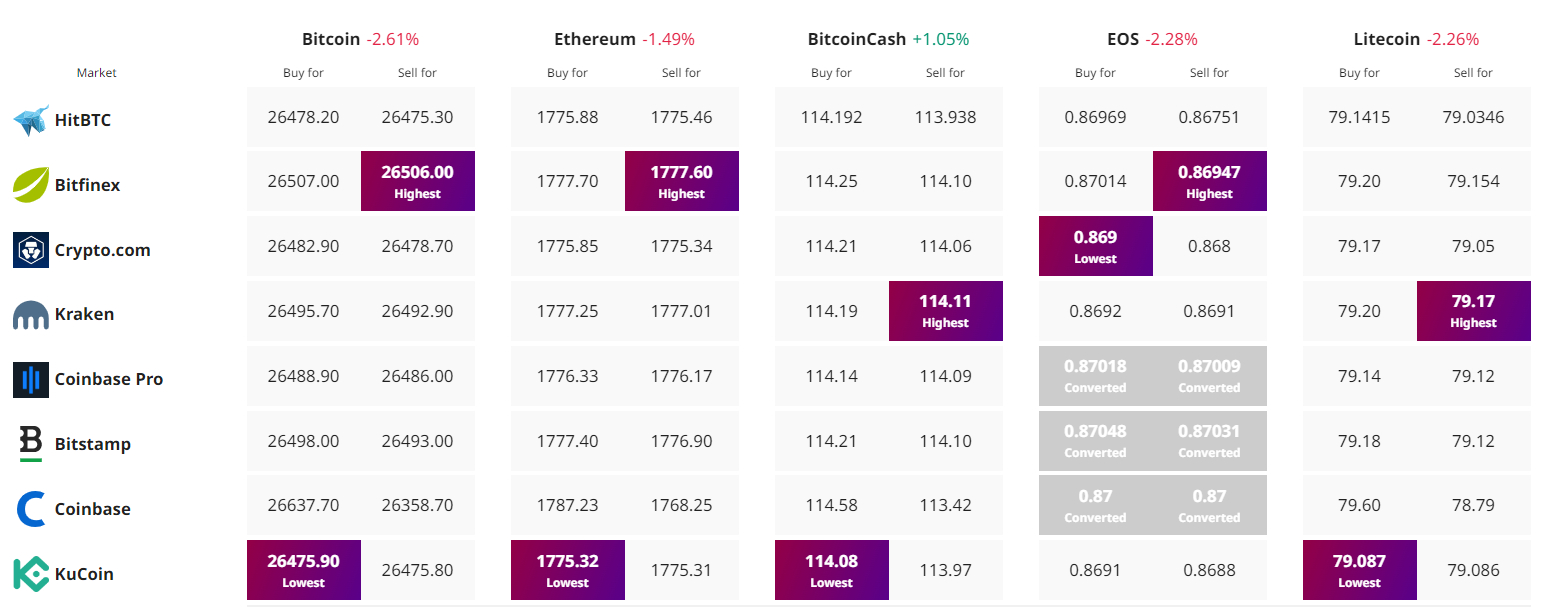

Find The Best Price to Buy/Sell Cryptocurrency