In Summary

- Africa remains a global gold powerhouse in 2025, with Ghana, the DRC, and South Africa leading production, collectively accounting for a major share of the continent’s gold output.

- Increased investments, mining reforms, and modernization have boosted production in countries like Burkina Faso, Côte d’Ivoire, and Tanzania, strengthening Africa’s mining infrastructure.

- Despite security and environmental challenges, gold mining continues to sustain millions of livelihoods, drive export revenues, and power economic growth across the continent.

Deep Dive!!!

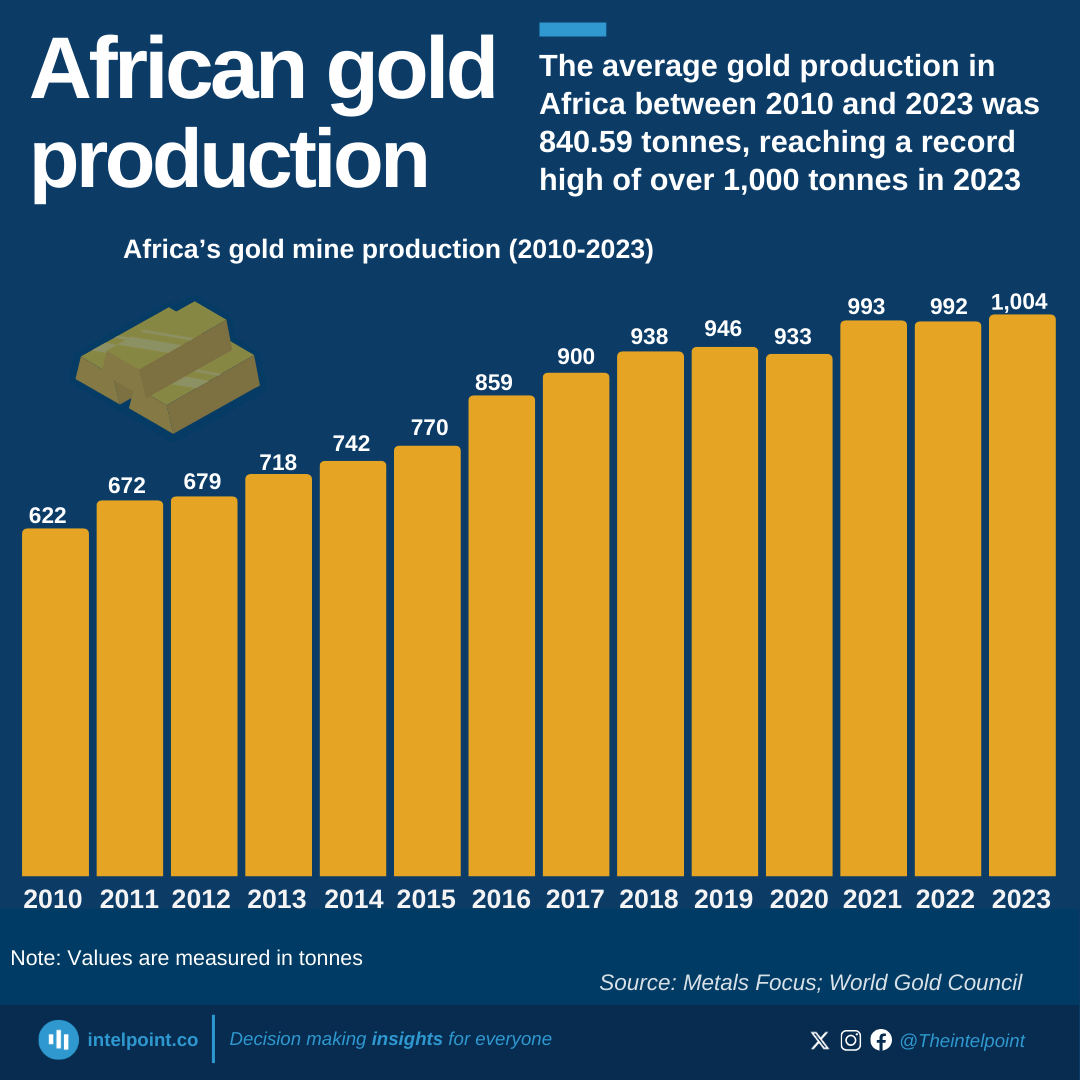

Friday, 24 October, 2025- Africa’s gold industry continues to shine brightly in 2025, cementing the continent’s role as a global powerhouse in mineral production and economic growth.

With countries like Ghana, the Democratic Republic of Congo, and South Africa leading the charge, the continent collectively contributes a significant share of the world’s gold output. Advancements in mining technology, stronger regulatory frameworks, and increased foreign investment have helped African nations expand both industrial and artisanal operations, turning gold into a cornerstone of national economies and rural livelihoods.

The surge in gold production across Africa has not only fueled export revenues but also provided vital foreign exchange and employment opportunities. Ghana, for instance, recorded approximately159 tonnes of gold in 2025, while the DRC and South Africa followed closely, each producing over 100 tonnes. Countries such as Burkina Faso, Côte d’Ivoire, and Tanzania have also strengthened their positions through government-backed mining reforms, infrastructure expansion, and partnerships with global firms like Barrick Gold and Endeavour Mining. These developments underscore Africa’s evolving mining landscape, marked by modernization and sustainability.

Beyond the numbers, the growth of gold mining in Africa represents a story of resilience and transformation. Despite challenges like political instability, environmental concerns, and informal mining, the sector remains a lifeline for millions.

From Ghana’s formalization of small-scale mining to the DRC’s industrial resurgence and Mali’s enduring output, the continent’s gold producers continue to adapt and thrive. Together, they form a dynamic network of economies driving industrial growth, technological progress, and social development across Africa in 2025.

10. Senegal

Senegal, historically a modest gold producer, is steadily transforming into a significant player in Africa’s gold sector. Key to this shift is the Sabodala-Massawa Gold Minein the Kédougou region operated by Endeavour Mining, which celebrated its latest expansion in early 2024. The government has backed this momentum by streamlining mining regulations and launching a roughly $1 billion investment plan for the Kédougou zone between 2024-2026, aiming to unlock further gold resource potential.

According to the latest semi-annual data from the national extractives body, gold production in the first half of 2024 reached about 106,579 troy ounces (approximately 3.3 tonnes) and accounted for the largest share of extractive-sector export revenue in that period. Although publicly available data for full-year 2024 and 2025 are still emerging, conservative estimates place Senegal’s total production for 2024-25 at around 9 tonnes (0.3 million ounces), supporting its ranking at #10 among African gold-producing nations.

However, Senegal’s burgeoning gold industry also faces notable challenges. Artisanal and small-scale mining remain widespread, particularly in the Kédougou region, where use of mercury and informal extraction methods have raised environmental and safety concerns. Furthermore, regulatory uncertainty, such as the 2024 suspension of mining activities around the Falémé river to protect the ecology, adds risk to future expansions.

Looking ahead to 2025 and beyond, Senegal appears well positioned for growth. With major projects like the Diamba Sud Gold Project (by Fortuna Mining Corp.) now estimating 724,000 ounces of indicated resources and 285,000 ounces inferred as of July 2025, the resource base is expanding rapidly. If the expanded capacity of Sabodala-Massawa and other mine developments deliver as projected, Senegal could soon surpass its current production estimates and climb higher in the African gold production ranking.

9. Guinea

Guinea has emerged in recent years as one of the continent’s up-and-coming gold producers. Historically under-exploited in the gold mining sphere, the country is now attracting substantial investment and seeing meaningful output growth. For example, the large industrial Siguiri mine (operated by AngloGold Ashanti) produced some 165,000 ounces (approximately 4.6 tonnes) of gold in the first half of 2025 alone—an increase of 28 % over H1 2024. This suggests that full-year production is in motion for a noteworthy rise, consistent with estimates of about 15 tonnes for 2024-25 for the country’s total output.

Investment momentum is strong in Guinea. In April 2025, the junior miner Robex Resources announced a roughly USD 171–185 million investment to bring the Kiniero gold mine into production in 2025; the project is expected to yield around139,000 ounces (approximately 4.3 tonnes)annually for nine years. On a broader scale, exploration firms spot Guinea’s gold reserves, estimated at around 700 tonnes, as a long-term growth area. Such upstream investment underscores the country’s potential to move further up Africa’s gold-producer rankings.

However, Guinea’s gold industry is still affected by structural and informal constraints. The majority of gold exports historically have derived from artisanal and small-scale mining, while industrial gold production remains smaller in proportion. Moreover, infrastructure, regulatory clarity, and environmental practices are areas of ongoing improvement. The government has made strides in establishing mining-friendly policy frameworks, yet the pace of industrial mine commissioning and sustainable formalization of artisanal activity remain key challenges.

Looking ahead, Guinea is well-positioned for further growth and possibly a higher ranking in Africa’s gold-production hierarchy. If the major new projects come online as planned and industrial production continues to accelerate—as early 2025 numbers suggest—Guinea could realistically target annual output exceeding 20 tonnes (≈0.64 million ounces) in the near term. This would strengthen its position among Africa’s top gold producers, driven by strong resource potential, increasing investment, and improved industrial operations.

8. Côte d’Ivoire (Ivory Coast)

Côte d’Ivoire has established itself as a rising star in Africa’s gold mining landscape. In 2024, the country’s gold production reached approximately 58 tonnes, and industry forecasts anticipate output rising to about 62 tonnes in 2025. Major mines such as the newly-commissioned Lafigué Gold Mine (operated by Endeavour Mining) and the Séguéla Gold Mine (operated by Fortuna Mining) are contributing significantly to the upward trajectory. For instance, Séguéla delivered76,686 ounces in H1 2025, up 13% year-on-year.

The government’s mining-sector reforms and investment-friendly policies have played a key role in this growth. According to the Mines Minister, Côte d’Ivoire’s gold production rose from 10 tonnes in 2012 to 58 tonnes in 2024, and is targeted to hit 62 tonnes in 2025. The mining industry’s contribution to GDP has grown from about 1.5% a decade ago to nearly 4% today, reflecting its increasing importance in the national economy.

Beyond volumes, the societal impact is also noteworthy. Mines like Lafigué are expected to produce up to 180,000-210,000 ounces annually and generate thousands of direct and indirect jobs in local communities, particularly in northern Côte d’Ivoire where alternative employment opportunities are limited. These operations contribute to rural livelihoods, infrastructure development, and regional economic diversification away from the country’s traditional reliance on cocoa production.

Looking ahead, Côte d’Ivoire’s gold industry appears poised for further breakthroughs. With several large-scale projects in the pipeline (such as the Koné Gold Mine) and hundreds of millions of dollars in planned investment, the country may soon challenge the top-ranked producers in West Africa. If the momentum is sustained, Côte d’Ivoire could approach a production threshold of 100 tonnes per annum in the coming years, strengthening its position in the continent’s gold-producing hierarchy.

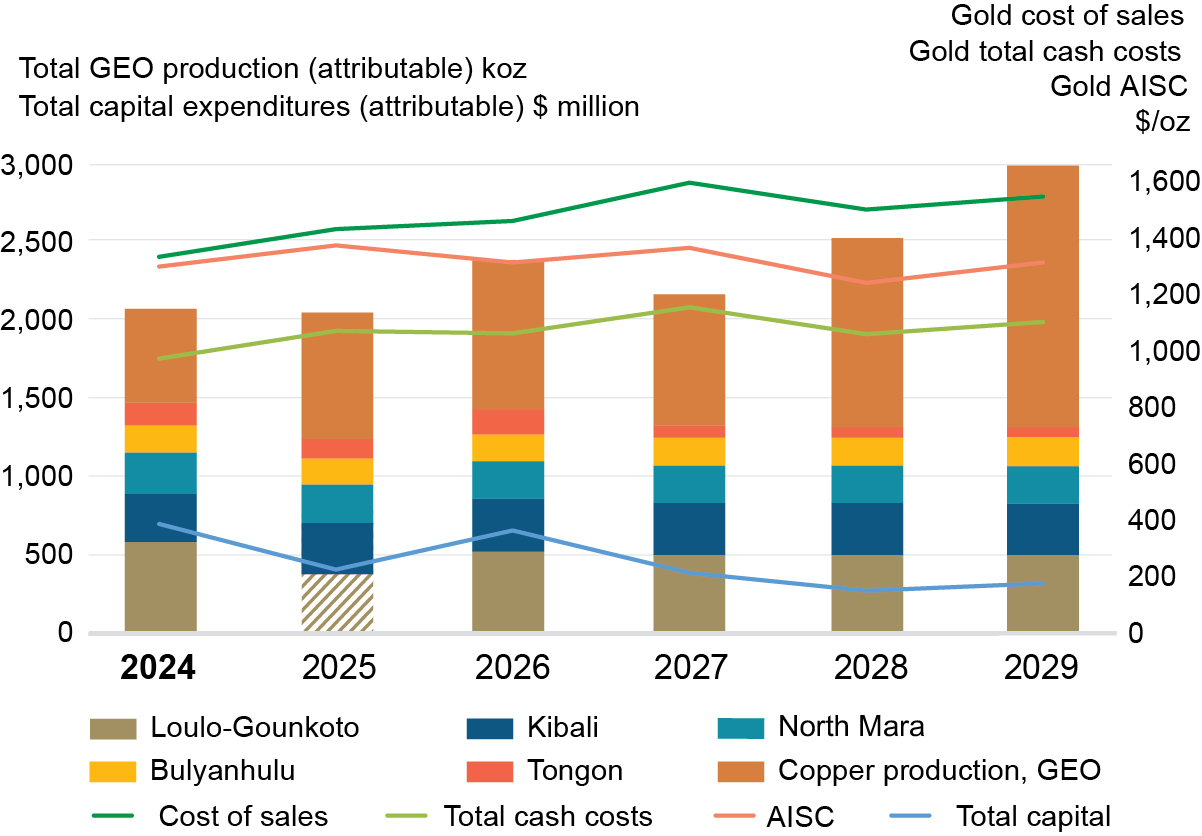

7. Tanzania

Tanzania remains one of East Africa’s leading gold producers, with significant output coming from large-scale mines such as Geita Gold Mine, Bulyanhulu Gold Mine and North Mara Gold Mine. According to Tanzania’s official Economic Survey, gold production in 2024 reached 61,680.81 kilograms (approximately 61.7 tonnes), up 12.6 % from the 54,760.32 kilograms produced in 2023. While older estimates placed Tanzania’s gold production at around 48 tonnes for the broader region, the official figures indicate a stronger performance and reaffirm the country’s place among Africa’s top producers.

The economic impact of gold production in Tanzania is also considerable. In the year ended January 2025, mineral exports surged to approximately $4.1 billion, with gold accounting for the largest share of these earnings at $3.4 billion. The export earnings show how integral gold is to Tanzania’s foreign exchange and non-traditional export profile, with the sector contributing a substantial proportion of national income beyond agricultural and conventional industries.

On the regulatory and investment front, Tanzania has undertaken reforms to strengthen its mining sector and attract further foreign direct investment. The government introduced incentives, streamlined licensing and refined local procurement rules, while major mining firms such as Barrick Gold Corporation (which operates Bulyanhulu) are operating under updated frameworks that aim to enhance local community benefits and stabilize production. These efforts are paying off: in the fourth quarter of 2024 the National Bureau of Statistics reported that gold output rose 21 % year-on-year for the quarter.

Looking ahead, Tanzania’s gold industry appears poised for further growth, though challenges remain. Artisanal and small-scale mining continue to account for a significant portion of total output (estimates suggest 40–50% from small-scale operations in regions such as Geita). Ensuring that this segment is formalized, environmentally managed and benefits local communities will be key to sustainable growth. If production trends continue and investments in infrastructure and mining efficiency hold, Tanzania is well positioned to maintain or improve its ranking among Africa’s top gold producers in 2025 and beyond.

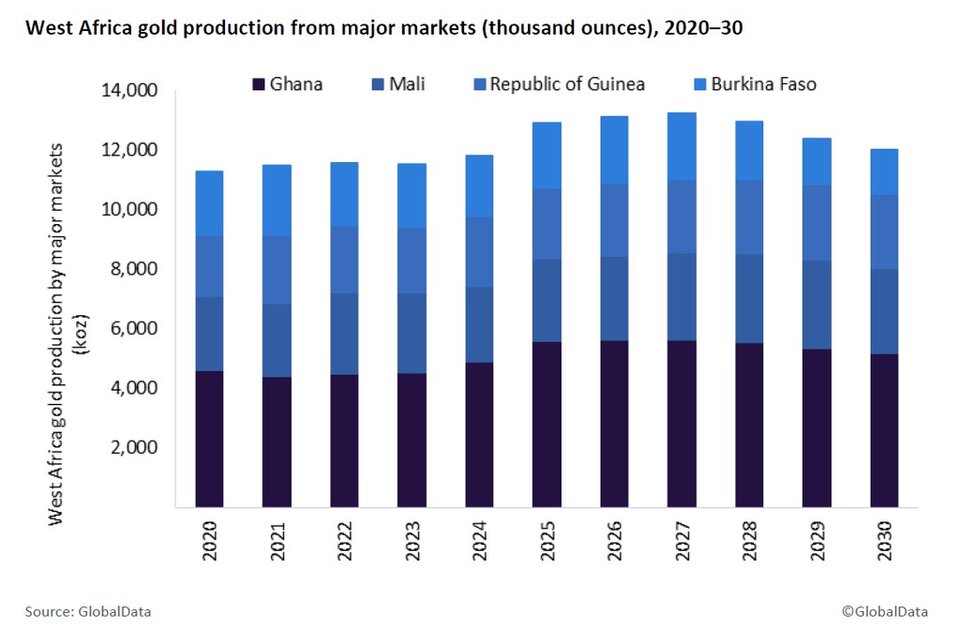

6. Burkina Faso

Burkina Faso remains a prominent gold producer in West Africa, with industrial gold production reachingapproximately 60.8 tonnes in 2024, up from 56.8 tonnes in 2023. While earlier estimates indicated 66–70 tonnes annually, more accurate recent official figures reflect a somewhat lower figure, though still significant. The country currently oversees 22 industrial mining permits with 13 active mines, underscoring the sector’s scale despite security and operational challenges.

The economic importance of the gold industry to Burkina Faso cannot be overstated. Gold accounted for about 84% of the country’s total export value in 2024, making it the dominant export commodity. The sector also generated direct state revenues of roughly 567.2 billion CFA francs (approximately $1.02 billion) in 2024, which supports infrastructure, education, and public finances. Employment and rural economic linkages are extensive, thousands of Burkinabé are employed in industrial mines, and informal artisanal mining activities also involve large numbers of miners.

Foreign mining companies remain active investors in Burkina Faso’s geology despite the country’s security challenges. The government in 2024 granted new large-scale mining licences (for example to Nordgold) and announced the construction of a gold refinery with an annual capacity of ~150 tonnes to add value locally. This reflects the state’s strategic emphasis on mineral sovereignty and increased local beneficiation, though the evolving regulatory environment and instability remain headwinds for some operators.

Looking ahead to 2025, Burkina Faso is poised to maintain its place among Africa’s leading gold producers, provided security and investment conditions hold. While production has declined from its 2021 peak (approximately 66.8 tonnes) to current levels (approximately 60.8 tonnes in 2024) due in part to disruptions, the expansion of export infrastructure, increased refining capacity, and reform of the artisanal mining sector may support future growth. The country’s deep gold resource base and majority-export economics mean that mining will remain a central pillar of Burkina Faso’s economy in 2025 and beyond.

5. Sudan

Sudan has witnessed a remarkable surge in gold production in the face of ongoing internal conflict, securing its place among Africa’s principal gold-producing nations. Official figures released by the Sudanese Mineral Resources Company (SMRC) report an output of approximately 64.4 tonnes in 2024, up from earlier years, in the state-controlled territory. Some independent estimates place the total (including unreported artisanal/illegal output) at closer to 80 tonnes annually, though the precise figure is difficult to confirm. Despite the war and disruptions, gold remains a critical revenue-earner and export asset.

The gold sector in Sudan accounts for a major portion of export earnings and is central to the country’s economic resilience. In the first ten months of 2024 alone, gold exports brought in $1.5 billion,according to government data. With gold contributing heavily to state finances and foreign-exchange earnings, the industry has become pivotal amidst the broader economic and humanitarian crisis. The SMRC has projected about 37 tonnes of production in the first half of 2025, underscoring its continued importance.

Formalizing and regulating the mining sector has become a policy priority for Sudan’s leadership. The government has implemented new export controls, restricted private gold-export channels and begun efforts to integrate artisanal mining into the formal economy. Yet the sector still faces serious challenges: smuggling is estimated to account for 50% or more of total production, with widespread informal mining and weak oversight undermining full revenue capture. In addition, regions under control of non-state armed groups (such as the Rapid Support Forces) operate mines independently, making regulation and safe operations difficult.

Looking ahead into 2025 and beyond, Sudan’s gold industry has significant upside if reforms hold, but risks remain high. With the official target around 80 tonnes annually, Sudan could strengthen its ranking among Africa’s top producers. However, addressing governance, security, environmental, and human-rights issues will be essential to ensure that gold production benefits the broader population and economy rather than fueling conflict or exploitation. In the coming years, how Sudan manages its gold sector could determine whether it remains a rising star of African gold production or one burdened by the same problems it seeks to escape.

4. Mali

Mali has long been foundational to West Africa’s gold mining belt, home to major operations such as the Loulo-Gounkoto complex and the Sadiola Gold Mine. However, according to the country’s Mines Ministry, industrial gold production declined significantly in 2024, falling by 23 % to approximately 51 metric tons (down from 66.5 tons in 2023). When including estimates for artisanal production (about 6 tons), total gold output was estimated around 58.7 tons in 2024.

This downturn reflects deeper structural challenges. Key mining corporations such as Barrick Gold suspended operations at Loulo-Gounkoto following adispute with the Malian government over the new mining code enacted in August 2023, which raised taxes and increased state participation in projects. This has affected investor confidence and hampered timely production scaling. The country’s mines ministry forecasts a modest rebound to about 54.7 tons in 2025, assuming Barrick resumes operations.

Economically, gold remains central to Mali’s export earnings and national fiscal health, contributing over 70 % of export revenues in recent years. Despite the production drop, the sector still underpins key foreign-exchange inflows and engages thousands of workers, directly and indirectly, especially in mining and logistics. However, security problems, particularly in the north and west, and evolving regulatory frameworks continue to pose risks to both growth and stability.

Looking ahead, Mali remains endowed with significant gold resources and potential upside. Its major gold mines continue to hold large reserves and expansion projects are in the pipeline. If regulatory issues are resolved and mining operations stabilize, the country has capacity to regain output momentum and maintain its place among Africa’s leading gold producers in 2025 and beyond.

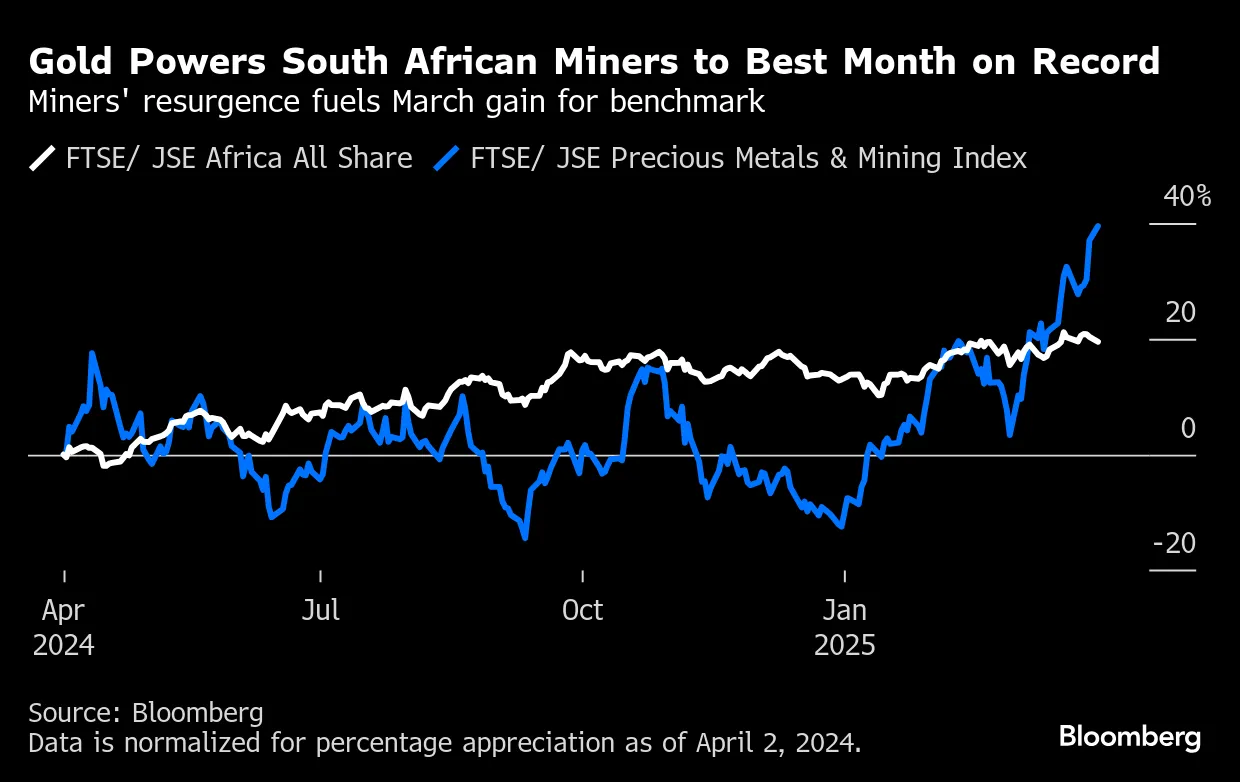

3. South Africa

South Africa, historically the world’s leading gold-producer, continues to maintain a significant mining presence despite years of decline. According to recent data from Statista, South Africa’s mine production of gold in 2024 is estimated at approximately 100 metric tons (100,000 kg). Although this is a fraction of its former peakannual output(which exceeded 1,000 tons in the 1970s), the country remains one of Africa’s largest producers by volume. The production level and established mining infrastructure justify its ranking at number three among Africa’s top gold-producing countries in 2025.

Even as output has dropped, South Africa’s gold industry still harnesses sophisticated mining infrastructure, deep-level underground operations and a highly skilled workforce. The 2025 mining sector report indicates that gold accounts for about 15 % of the country’s overall mining production volume and underscores the presence of well-developed logistics, processing and global linkages. Major mining companies such as Harmony Gold and Gold Fields operate within South Africa and continue to invest in technology, mechanisation and automation to offset challenges such as declining grades, increasing depths and rising costs.

The country’s gold-mining sector also interacts closely with other commodities, particularly platinum-group metals (PGMs) and diamonds, through shared infrastructure, mine-service facilities and regulatory frameworks. This multifaceted resource base helps anchor employment and export earnings. However, the industry faces mounting challenges: age-ing mines, declining ore grades, deeper shafts, load-shedding and electricity constraints, as well as illegal mining (“zama zamas”) undermining formal operations. Experts warn that without renewed investment in exploration and mine renewal, the country’s gold-production capability could shrink further.

Looking ahead into 2025, South Africa is positioned to maintain its ranking among the continent’s top gold producers, but only if key structural issues are addressed. Production in 2024 stood near 100 tons, and if the country can stabilise costs, upgrade infrastructure and support new projects, further upside exists. At the same time, continued decline could see its relative standing slip as other African producers ramp up. The industry’s ability to modernise operations, integrate smaller-scale producers and leverage its strong institutional foundation will determine whether South Africa remains a major gold-producer in Africa’s evolving mining landscape.

2. Democratic Republic of Congo (DRC)

The Democratic Republic of Congo (DRC) has rapidly assumed a more prominent position in Africa’s gold-producing hierarchy, driven by significant investment in large-scale industrial gold operations. Among these, the Kibali Gold Mine, located in Haut-Uélé province and operated by Barrick Gold and its partners, is a central pillar: in 2024 it produced approximately 26 075 kg (approximately 26.1 tonnes) of gold, representing over 99 % of industrial output for the country.

However, broader estimates of the DRC’s total gold production, factoring in artisanal and semi-industrial output, continue to vary and are less well documented; some industry observers place the total annual output closer to the 100-tonne mark when informal production is included.

Economically, the gold sector has become a critical export earner for the DRC. Official data indicate that in 2024 the country exported 27.9 tonnes of gold, valued at approximately $1.5 billion, with the large majority generated by the Kibali mine. The gold mining industry also supports infrastructure and regional development, though these benefits are not always evenly distributed. Moreover, the government’s 2025 budget anticipates that mining, including gold, will underpin GDP growth of around 5.7%, underscoring the sector’s strategic significance.

Despite this momentum, the DRC’s gold industry remains beset by challenges. A major concern is the dominance of the Kibali mine, which in Q1 2025 alone produced 5,865.62 kg of gold, representing 99.5% of the country’s reported output for the period. The concentration of production places the sector at operational risk should any disruptions occur. Meanwhile, ongoing security concerns in eastern Congo, including rebel control of mining hubs and transport routes, pose latent threats to production continuity and investor confidence. Additionally, the large scale of artisanal and small-scale mining (ASM) remains challenging to monitor, and smuggling continues to erode potential state revenue.

Looking ahead to 2025 and beyond, the DRC’s gold sector holds significant upside if structural reforms succeed and investment continues. The country boasts vast unexploited reserves (for instance the Kibali complex alone is estimated to hold over 315 tonnes of combined proven and probable reserves). If the DRC can formalize more artisanal mines, improve governance, and advance downstream value-capture (refining and processing locally), then gold production could rise—strengthening the DRC’s ranking among Africa’s top producers and potentially narrowing the gap with front-ranked nations.

1. Ghana

Ghana continues to assert its position at the summit of Africa’s gold-producing nations, with industry projections for 2025 placing output at approximately 5.1 million ounces (around 159 tonnes). This follows a robust 2024, when production hit record levels, rising 19.3% year-on-year, as both large-scale and small-scale mining operations expanded their output.

Gold now dominates Ghana’s export economy, comprising roughly 57% of total exports in 2024 and significantly bolstering national revenues. In that year alone, the country earned about $11.6 billion from gold exports. This inflow has played a critical role in stabilizing the cedi and shoring up foreign reserves.

A notable feature of Ghana’s gold sector is the surge in artisanal and small-scale mining (ASM), which in 2024 contributed 1.9 million ounces, roughly 39% of national output. This reflects both rising gold prices and increased formalization efforts, though it also raises challenges of regulation, environmental impacts, and revenue leakage.

Looking ahead, expansion projects such as Ahafo South and Namdini are expected to drive further growth, underpinning the forecasted increase to 5.1 million ounces in 2025. At the same time, Ghana has introduced GoldBod (the Ghana Gold Board) in 2025, centralizing gold purchases from licensed miners to limit smuggling and ensure more export earnings flow through official channels.

![Top 10 Gold Producers in Africa in 2025 [UPDATED]](https://nigeriacurrently.com/wp-content/uploads/2025/10/1687453303305-1024x683.jpeg)