In Summary

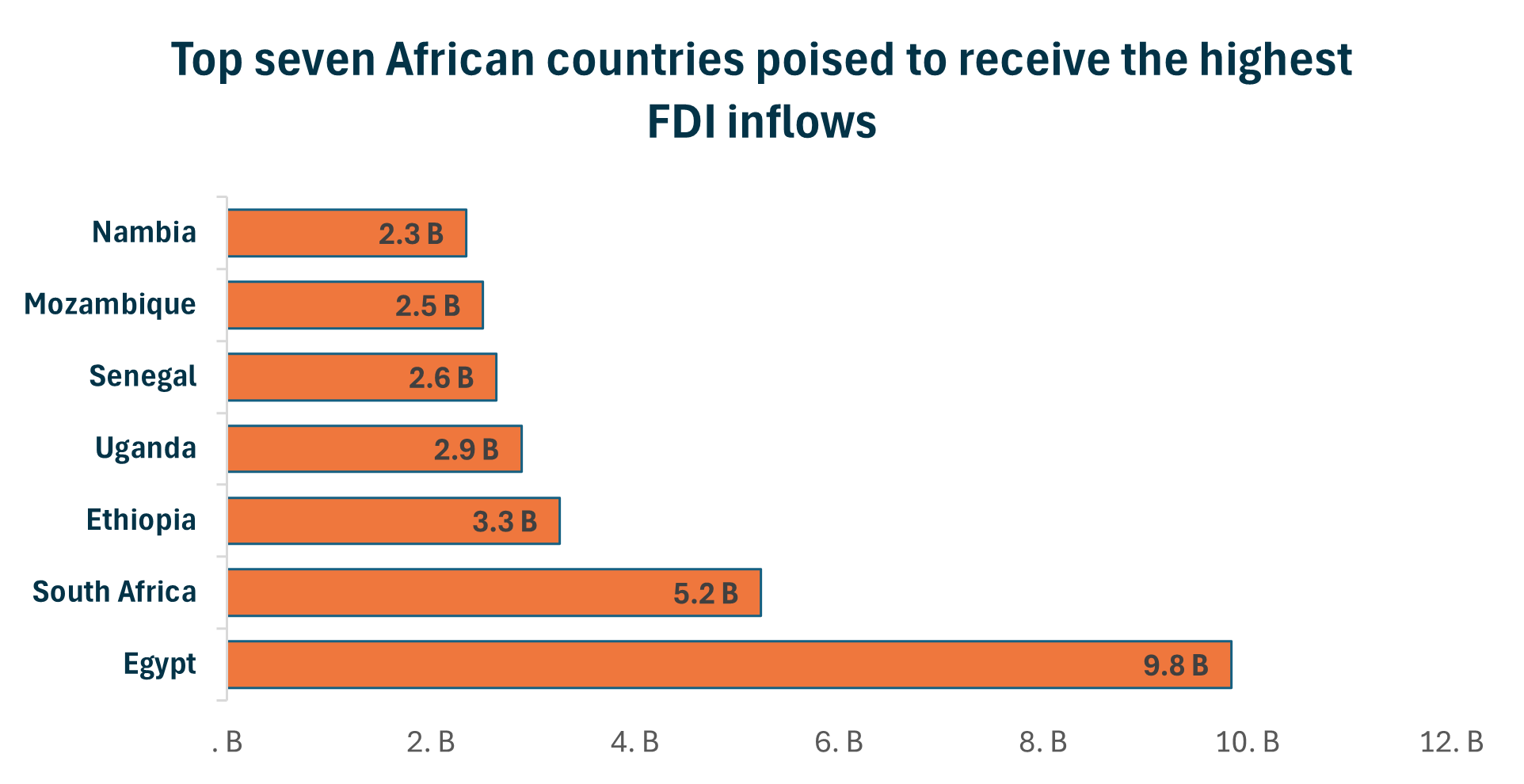

- Egypt dominates Africa’s FDI landscape, attracting over $46 billion in 2024, driven by massive Gulf-backed projects like the Ras El-Hekma development, positioning it as the continent’s leading destination for foreign equity in 2025.

- Ethiopia, Côte d’Ivoire, Mozambique, and Uganda follow as strong performers, fueled by industrialization, energy infrastructure, and manufacturing projects that highlight Africa’s diversification beyond extractives.

- Overall FDI trends in 2025 show Africa’s shift toward renewables, logistics, and industrial value chains, as investors increasingly reward nations with stable governance, improved business climates, and clear long-term development strategies.

Deep Dive!!!

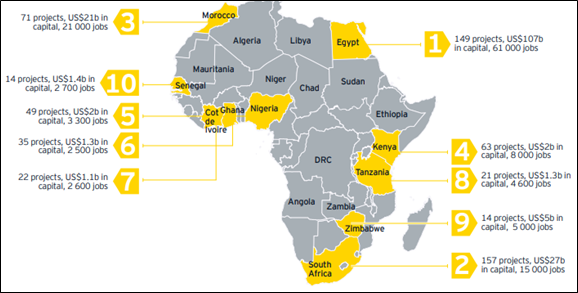

Sunday, 26 October 2025 – Foreign Direct Equity Inflows (FDEI) across Africa have undergone a notable transformation between 2024 and 2025, reflecting shifting investor priorities, macroeconomic resilience, and the continent’s growing relevance to global industrial and energy supply chains. The United Nations Conference on Trade and Development (UNCTAD) and other 2025 provisional data sources show that while overall FDI to Africa remains uneven, a handful of economies have managed to attract large volumes of equity investment, driven by strategic reforms, strong project pipelines, and a renewed global appetite for energy transition assets, infrastructure, and value-chain integration. The composition of inflows underscores how macro stability and predictable policy environments are now as important as natural resource endowment in determining where capital flows.

Egypt stands out dramatically, accounting for an exceptional share of Africa’s total inflows in 2024, thanks to multi-billion-dollar Gulf-backed investments in real estate, tourism, and energy infrastructure. Yet beyond Egypt’s headline dominance, several emerging economies, including Ethiopia, Côte d’Ivoire, Mozambique, Uganda, and the Democratic Republic of Congo (DRC), have demonstrated sustained investor confidence through consistent project-level equity commitments. These inflows, often tied to long-term industrial and renewable energy initiatives, are positioning parts of East, West, and Southern Africa as key hubs for diversified investment, regional logistics, and green industrialisation. Such diversification hints at a broader continental shift: from extractive-heavy portfolios toward more balanced, sectorally varied capital formation.

This ranking of the Top 10 African Countries with the Most Foreign Direct Equity Inflows in 2025 draws on verifiable data from UNCTAD, fDi Intelligence, andDabafinance’s 2024–25 updates. It not only highlights the monetary value of investments but also analyses the structural and policy factors underpinning these flows. Together, these insights provide a comprehensive view of how Africa’s leading economies are leveraging industrial policies, investor partnerships, and megaproject financing to consolidate their positions as premier destinations for global capital. The report underscores both the opportunities and the cautionary dynamics shaping Africa’s investment trajectory in 2025.

10. Guinea

Guinea’s surge in inward foreign-equity flows in 2024 placed it among Africa’s top ten recipients, with industry compilations and national reports estimating inflows in the $1.8–2.0 billion range for the year. Much of the headline increase reflects project-level equity and reinvested earnings tied to large mining and infrastructure deals rather than a broad-based wave of small-scale FDI, so while the totals are material, they concentrate in a handful ofstrategic projects and investors.

The dominant driver has been Guinea’s export-grade mineral endowment, especially the dramatic expansion in bauxite shipments and the development of mega-projects such as Simandou and new alumina-refinery agreements. Strong demand from China and major off-takers lifted recorded exports and supported new capital commitments: industry data show record bauxite volumes and continuing large-scale port and rail investments that underpin equity placements in 2024–25. In parallel, framework deals, such as the 2024 term sheet with Guinea Alumina Corporation (GAC)/EGA for a multi-billion-dollar refinery, have signalled substantial downstream investment intentions that feed into measured equity inflows.

That concentration of inflows, however, also amplifies vulnerability. Guinea’s political landscape (including the post-2021 coup authorities) and active regulatory interventions have periodically disrupted operations: high-profile license disputes and temporary suspensions (for example involving EGA and other firms) have heightened investor uncertainty and complicated project timelines. Commodity-price swings (notably in bauxite and iron ore) and operational risks, ports, rainy-season logistics and local content requirements, mean recorded equity can be volatile year-to-year and sensitive to policy shifts.

Looking forward into 2025, Guinea’s near-term prospects remain closely tied to how the authorities manage large projects and investor relations. If major projects (Simandou, LNG-adjacent infrastructure, alumina refineries) proceed to production and the government implements clearer, investor-friendly value-addition policies, equity inflows could stay elevated and translate into broader economic gains, IMF and market commentators even flag potential multi-percent boosts to GDP over the medium term from major mine openings. Equally, sustained investor confidence will require greater transparency, stable licensing terms, and mitigation of governance and security risks; absent those assurances, future equity flows may prove episodic rather than structural.

9. Senegal

Senegal continues to consolidate its position as one of West Africa’s most promising investment destinations, propelled by structural reforms, macroeconomic stability, and ongoing infrastructure development. According to UNCTAD’s World Investment Report 2025 and data from Dabafinance, Senegal attracted approximately US$2.0 billion in foreign direct equity inflows in 2024, a performance sustained into 2025 through energy and logistics-linked projects. The government’s commitment to the Plan Sénégal Émergent (PSE), its long-term development strategy, has created a business environment conducive to sustained foreign participation, especially in strategic sectors like energy, infrastructure, and industrial zones.

A key driver of Senegal’s FDI momentum has been the Grand Tortue Ahmeyim (GTA) offshore gas project, co-developed with Mauritania, which entered critical phases in 2024–2025. This single megaproject, coupled with rapid growth in renewable energy, particularly solar and wind concessions—has boosted equity inflows from European, Middle Eastern, and Asian investors seeking to diversify Africa portfolios beyond Nigeria and Ghana. These investments not only expand the energy base but also reinforce Senegal’s role as a future energy hub for the region.

Additionally, the port of Ndayane and Dakar’s special economic zones have become magnets for logistics, manufacturing, and ICT-related investment. Senegal’s strategic Atlantic coastline, political stability, and ongoing legal reforms to streamline business registration and tax codes continue to enhance its attractiveness. The World Bank’s 2025 Doing Business reforms update ranks Senegal among the most improved African economies in investment facilitation, underscoring growing investor confidence.

However, the pace of inflows remains subject to project-specific timing and global capital market conditions. While 2025 data show consistent equity injections, analysts note that Senegal’s reliance on large-ticket infrastructure and energy projects could lead to year-on-year fluctuations in total inflows. Nonetheless, the trajectory remains upward, driven by diversification efforts, regional connectivity ambitions, and a firm governmental push toward sustainable industrialization, keeping Senegal solidly within Africa’s top 10 FDI equity destinations.

8. Namibia

Namibia’s foreign direct equity inflows surged in 2024 and 2025, driven primarily by large-scale energy and mining investments. According to UNCTAD’s World Investment Report 2025 and Dabafinance data, Namibia attracted between US$2.0 billion and US$2.1 billion in equity inflows, positioning it firmly among Africa’s top ten destinations for FDI. This performance was underpinned by global investor confidence in Namibia’s stable regulatory environment and vast natural resource potential, especially its emerging green energy and offshore oil sectors. The government’s efforts to strengthen fiscal transparency and simplify investment procedures also bolstered Namibia’s reputation as a low-risk, high-return frontier market in Southern Africa.

The biggest catalyst behind Namibia’s inflow surge has been its rapidly expanding energy sector, particularly the landmark Hyphen Hydrogen Energy project, valued at over US$10 billion, which began preparatory phases in 2024. This initiative, one of Africa’s largest green hydrogen ventures, has drawn substantial European and Asian interest, positioning Namibia as a future hub for renewable energy exports. Additionally, offshore oil discoveries by TotalEnergies and Shell in the Orange Basin have triggered a wave of exploration and equity injections from global energy players, boosting both the country’s foreign reserves and long-term investor appeal.

Beyond energy, Namibia’s mining sector, notably uranium, lithium, and copper, continues to attract steady inflows, aligning with the global transition toward clean technologies. The growing demand for critical minerals has placed Namibia in a strategic position within the global supply chain. In 2025, Chinese, Canadian, and Australian firms expanded their stakes in local mining ventures, contributing to sustained FDI momentum. This mineral-driven growth, combined with the government’s push for local value addition, signals a maturing investment ecosystem that is increasingly diversified yet still heavily commodity-linked.

Despite these advances, Namibia’s FDI inflows remain concentrated in capital-intensive sectors, limiting spillovers to smaller enterprises and broader job creation. Analysts caution that maintaining momentum will depend on deepening industrial linkages and strengthening infrastructure to support energy exports. Nonetheless, Namibia’s forward-looking energy policy, political stability, and strategic positioning between South Africa and Angola continue to make it one of Africa’s most attractive mid-sized investment destinations in 2025, an example of how resource wealth, when paired with reform and sustainability goals, can anchor long-term foreign equity growth.

7. South Africa

South Africa maintained its position as one of Africa’s leading destinations for foreign direct equity inflows in 2024–2025, attracting between US$2.4 billion and US$2.5 billion in equity investment, according to UNCTAD’s World Investment Report 2025 and Reuters data. The country’s appeal stems from its well-developed financial markets, diversified industrial base, and strong corporate governance frameworks, which continue to attract both portfolio and long-term equity investors. South Africa’s robust stock exchange, the Johannesburg Stock Exchange (JSE), acts as a gateway for international investors seeking exposure to African assets, while the government’s push to streamline investment regulations through the Investment Promotion and Protection Bill has bolstered investor confidence amid global uncertainty.

A major contributor to inflows has been cross-border mergers and acquisitions (M&A) and the reinvestment of earnings by multinational companies with existing operations in South Africa. In 2024, notable deals included foreign equity participation in renewable energy projects, mining ventures, and technology firms expanding under the Just Energy Transition program. The renewable sector, particularly solar and wind energy, saw new commitments from European investors aligned with South Africa’s green industrialization strategy. Additionally, private equity and venture capital inflows into fintech, logistics, and manufacturing signaled renewed investor appetite for high-growth sectors beyond traditional mining and energy.

However, South Africa’s investment climate remains mixed, shaped by recurring power shortages, infrastructure bottlenecks, and policy uncertainty in sectors such as mining and telecommunications. While these challenges have caused episodic capital outflows and temporary slowdowns, the overall trend of reinvested profits and new equity injections from established global corporations such as Anglo American, Heineken, and Volkswagen underscores sustained investor confidence in South Africa’s long-term fundamentals. The country’s deep pool of skilled labor, mature capital markets, and regional trade connectivity continue to outweigh cyclical risks, preserving its attractiveness as a continental FDI leader.

Looking into 2025, preliminary data from the South African Reserve Bank (SARB) shows intermittent spikes in quarterly equity inflows tied to large corporate restructuring deals and green infrastructure financing. As South Africa accelerates its energy transition and digital infrastructure build-out, analysts project steady FDI inflows supported by global partnerships, particularly in clean energy and manufacturing. While competition from emerging African markets such as Morocco and Egypt is intensifying, South Africa’s institutional strength and investment depth ensure it remains a critical anchor for foreign direct equity inflows in sub-Saharan Africa.

6. Democratic Republic of Congo (DRC)

The Democratic Republic of Congo (DRC) sustained strong momentum in foreign direct equity inflows in 2024–2025, largely driven by its booming mining and energy sectors. According to UNCTAD’s World Investment Report 2025 and Dabafinance’s Africa FDI Monitor, the DRC attracted approximately US$3.1 billion in inward FDI in 2024, with projections indicating similar or higher inflows into 2025. This growth reflects investors’ continued appetite for the DRC’s vast reserves of copper, cobalt, gold, and lithium, key minerals underpinning the global energy transition and electric vehicle (EV) supply chains. As global demand for clean energy inputs accelerates, the DRC’s mineral wealth has positioned it as a strategic hub for equity investors and multinational corporations seeking to secure critical raw materials.

Large-scale mining ventures spearheaded much of this investment. The Kamoa-Kakula copper complex, operated by Ivanhoe Mines and Zijin Mining, continued to attract substantial foreign capital, expanding its production capacity and integrating new processing infrastructure in 2024–25. Parallel projects in the Kolwezi and Kibali regions, focused on gold and battery minerals, also drew multinational financing from Chinese, Canadian, and Middle Eastern investors. These developments have not only lifted overall FDI inflows but have also spurred ancillary investments in energy, transport, and logistics infrastructure, as companies seek to enhance export efficiency. Notably, the DRC government’s push for local value addition, including the planned construction of battery precursor facilities, has begun attracting equity investments from manufacturing and energy storage companies exploring onshore operations.

However, the DRC’s FDI profile remains highly concentrated and risk-sensitive, with inflows largely tied to a few mega-projects and global commodity price trends. Political volatility, regulatory unpredictability, and logistical constraints continue to pose challenges to broader investor participation. Data from the Central Bank of Congo (BCC) and World Bank 2025 country updates highlight that while large projects sustain the bulk of inflows, smaller investors often face difficulties navigating bureaucratic and infrastructural barriers. Nonetheless, reforms under the Mining Code and investment promotion framework, including fiscal incentives and partnership guarantees, have improved transparency and helped stabilize investor sentiment.

Looking ahead, 2025 is expected to consolidate the DRC’s position among Africa’s top FDI recipients, especially as green industrialization and EV supply chain localization gain traction. Continued financing from China’s Belt and Road Initiative (BRI) and private equity inflows from Europe and the Gulf are likely to reinforce the DRC’s strategic importance. While diversification beyond extractives remains limited, the growing focus on downstream processing, renewable energy, and regional infrastructure offers pathways for more balanced and sustainable equity inflows. With global markets turning toward resource security and clean technology, the DRC’s ability to leverage its resource endowment while improving governance will be pivotal in maintaining its standing as one of Africa’s foremost FDI destinations in 2025.

5. Uganda

Uganda maintained a strong trajectory in foreign direct equity inflows through 2024 and into 2025, supported by a combination of renewable energy expansion, infrastructure development, and agribusiness investments. According to Dabafinance Africa Investment Reports (2025) and UNCTAD’s 2025 World Investment Report, Uganda attracted approximately $3.3 billion in FDI in 2024, reflecting growing global investor confidence in its diversified project pipeline. The government’s sustained efforts to position Uganda as a regional investment hub, through initiatives such as the Public Investment Management Strategy and National Development Plan III (NDPIII), have enhanced the country’s appeal for long-term equity capital. In 2025, continued interest from European and Asian investors in clean energy and transport infrastructure solidified Uganda’s rank among the top five African FDI recipients.

A key driver of Uganda’s FDI performance has been the renewable energy sector, which has become a magnet for foreign equity. Projects such as the Ayago Hydropower Project, Isimba and Karuma hydro expansions, and solar initiatives in Soroti and Gulu attracted significant external financing from development partners, private equity funds, and regional financiers. The Africa Green Finance Facility (AGFF) and AfDB-backed Uganda Solar Scaling Initiative further boosted investor participation in renewable projects through de-risking frameworks and public-private partnerships (PPPs). These investments have expanded Uganda’s power generation capacity, improving industrial competitiveness and rural electrification, both key priorities under the government’s Vision 2040 agenda. The focus on energy security not only attracts equity inflows but also underpins broader economic growth prospects.

In parallel, Uganda’s transport and logistics infrastructure has drawn increasing FDI, particularly from China and regional development financiers. The Kampala–Jinja Expressway, Standard Gauge Railway revival efforts, and upgrades at Entebbe International Airport have seen substantial foreign participation, including from the China Exim Bank and European Investment Bank (EIB). These projects are crucial for enhancing trade efficiency and positioning Uganda as a key East African transit economy, linking the Great Lakes region to coastal ports. The Uganda Investment Authority (UIA) reports that infrastructure-related equity projects accounted for a significant share of 2024 inflows, while agriculture and agro-processing attracted new European and Gulf-based partnerships focused on export-oriented value chains in coffee, dairy, and grains.

However, Uganda’s investment landscape still faces constraints. Structural challenges such as bureaucratic delays, limited industrial infrastructure, and policy uncertainty in land and taxation deter smaller equity players. Nonetheless, the government’s reforms in investment licensing, digital registration, and tax incentives, as part of its One-Stop Investment Centre program, have begun to address these bottlenecks. The 2025 outlook remains optimistic, with analysts from Dabafinance and Fitch Solutions projecting stable FDI inflows supported by energy transition investments, oil pipeline projects under the EACOP, and growing confidence in Uganda’s macroeconomic stability. As Uganda continues to balance industrialization and sustainability, its ability to attract green and long-term equity capital will define its next phase of growth in Africa’s FDI landscape.

4. Mozambique

Mozambique sustained robust foreign direct equity inflows through 2024 and into 2025, largely anchored in liquefied natural gas (LNG), mining, and infrastructure megaprojects. According to Dabafinance (2025) and the UNCTAD World Investment Report 2025, Mozambique recorded an estimated US$3.5 billion in FDI inflows in 2024, ranking it fourth on the continent. The primary drivers of this surge were renewed activity in the Rovuma Basin LNG projects, significant investments in coal and graphite mining, and strategic port and logistics expansions in Nacala and Beira. Despite occasional delays due to security concerns in Cabo Delgado, Mozambique remains a top destination for long-term investors seeking exposure to Africa’s natural resource and energy transition sectors.

The LNG sector continues to dominate Mozambique’s FDI narrative. The resumption of development works in TotalEnergies’ US$20 billion Mozambique LNG project and ongoing exploration by ExxonMobil and Eni have attracted large equity stakes from multinational investors. LNG exports are expected to transform Mozambique’s fiscal position and foreign exchange reserves over the next decade. In parallel, the energy and infrastructure sectors benefited from diversified investments in renewable projects such as the Temane Regional Energy Project and solar installations under the World Bank’s ProEnergia initiative. These inflows align with Mozambique’s long-term objective to become a regional energy exporter while fostering industrialization and job creation domestically.

Mozambique’s infrastructure and logistics sectors have also experienced increased foreign participation, particularly in projects that enhance trade connectivity. The Maputo–Katembe Bridge, Nacala Logistics Corridor, and ongoing port expansions have drawn capital from Chinese, Japanese, and Gulf investors, reflecting Mozambique’s strategic positioning as a southern African gateway for regional trade. These projects not only facilitate energy exports but also support agricultural and industrial supply chains, enhancing overall economic diversification. The government’s partnerships with development finance institutions, such as the African Development Bank (AfDB) and Japan International Cooperation Agency (JICA), have further supported project viability through blended finance and credit guarantees, mitigating risks associated with large-scale investments.

Nevertheless, Mozambique’s investment environment remains dual-faced, marked by strong project-level performance but challenged by governance, security, and bureaucratic risks. The Dabafinance 2025 Country Risk Outlook highlights lingering investor concerns over debt transparency, foreign exchange regulation, and insurgency disruptions. Yet, macroeconomic reforms, including fiscal stabilization efforts, energy-sector liberalization, and the strengthening of the Investment and Export Promotion Agency (APIEX), have improved investor sentiment. Going into 2025, Mozambique’s outlook remains positive, underpinned by its vast natural resources, improving infrastructure, and accelerating participation in global energy markets. Its ability to translate large-scale project inflows into broad-based economic growth will determine the sustainability of its position among Africa’s top FDI destinations.

3. Côte d’Ivoire

Côte d’Ivoire’s performance in foreign direct equity inflows through 2024 and into 2025 underscores its emergence as one of West Africa’s most dynamic investment destinations. According to Dabafinance (2025) and the UNCTAD World Investment Report 2025, the country attracted approximately US$3.8 billion in inward FDI in 2024, placing it among the continent’s top three equity recipients. This growth reflects investor confidence in Côte d’Ivoire’s macroeconomic stability, pro-business reforms, and strong governance framework, as well as the government’s strategic focus on industrializing its vast agricultural base. Despite global economic uncertainty, Côte d’Ivoire’s diversified economy, anchored in cocoa, cashew, palm oil, and energy, continued to attract both greenfield and reinvestment projects from multinational corporations and regional investors.

The agribusiness and manufacturing sectors have been the cornerstone of Côte d’Ivoire’s FDI momentum. Major investments in cocoa and cashew nut processing facilities have positioned the country as a hub for regional value addition, in line withECOWAS’s broader industrialization goals. Leading firms such as Olam Agri, Cargill, and Barry Callebaut expanded operations in Abidjan and San Pedro, reflecting the government’s success in incentivizing local transformation through tax breaks and export facilitation measures. The African Development Bank (AfDB) also reported increased investor participation in agro-industrial corridors, which combine logistics, processing, and power generation. This sectoral diversification is helping Côte d’Ivoire reduce dependence on raw commodity exports while stimulating local employment and supply chain resilience.

Infrastructure and energy-sector investments also remain key pillars of Côte d’Ivoire’s attractiveness to equity investors. The country continues to expand its power generation capacity, supported by foreign-backed projects such as Azito Energie’s natural gas plant expansion and Ciprel’s combined-cycle power projects. In parallel, large-scale transport infrastructure, such as the Abidjan Metro, San Pedro Port modernization, and road network upgrades under the Programme National de Développement (PND) 2021–2025, have deepened investor confidence. These initiatives enhance regional trade integration, positioning Côte d’Ivoire as a logistics and energy hub for West Africa. The government’s commitment to public–private partnerships (PPPs) and investment-friendly regulation has further boosted private capital participation, particularly from European, Asian, and Middle Eastern investors.

Looking ahead, Côte d’Ivoire’s 2025 investment outlook remains strongly positive, buoyed by macroeconomic stability, robust GDP growth (projected above 6%), and political continuity under the government’s ongoing reform agenda. However, analysts caution that sustaining momentum will require continued attention to bureaucratic efficiency, energy affordability, and export logistics bottlenecks. The Dabafinance 2025 Country Risk Overview notes that while Côte d’Ivoire’s debt ratios remain manageable, rising global financing costs could pressure fiscal buffers. Nonetheless, the country’s combination of economic diversification, infrastructure modernization, and strong governance has firmly entrenched it among Africa’s top destinations for foreign direct equity inflows in 2025, signaling a continued shift of investor attention toward West Africa’s emerging industrial economies.

2. Ethiopia

Ethiopia’s foreign direct equity inflows remained robust through 2024 and into 2025, consolidating its position as one of Africa’s leading investment destinations. According to Dabafinance (2025) and the UNCTAD World Investment Report 2025, Ethiopia attracted an estimated US$4.0 billion in FDI inflows in 2024, driven primarily by manufacturing, industrial parks, and energy infrastructure. Despite persistent macroeconomic challenges, including inflationary pressures and foreign exchange shortages, the country’s large domestic market and sustained industrialization strategy under the Homegrown Economic Reform Agenda (HERA II) continued to appeal to both regional and international investors. The government’s commitment to expanding export-oriented industries, supported by targeted investment incentives and the liberalization of select sectors, has made Ethiopia a consistent magnet for equity capital across East Africa.

The industrial park program, which anchors Ethiopia’s manufacturing strategy, played a pivotal role in attracting equity investment during this period. Major Chinese, Turkish, and Indian investors deepened their presence in parks such as Hawassa, Bole Lemi, and Kombolcha, focusing on textiles, apparel, and light manufacturing. Data from the Ethiopian Investment Commission (EIC, 2025) shows an uptick in reinvestment by existing firms as export recovery strengthened after pandemic-related disruptions. Moreover, World Bank reporting in early 2025 noted that Ethiopia’s industrial parks collectively generated thousands of new jobs and significantly increased manufactured export revenues, reinforcing investor confidence in the government’s long-term economic diversification agenda. This steady pipeline of greenfield projects, supported by improved logistics and infrastructure around the Modjo Dry Port and Addis–Djibouti Corridor, has been a major catalyst for sustained FDI inflows.

Ethiopia’s energy and infrastructure sectors have also been key contributors to its equity inflows, attracting large-scale investment commitments. The Grand Ethiopian Renaissance Dam (GERD), alongside renewable projects in solar and wind energy, drew private-sector participation through foreign engineering and financing partnerships. According to African Energy Chamber data, Ethiopia’s energy sector accounted for over 20% of total foreign equity commitments in 2024–25. Additionally, growing interest in logistics concessions, including the Addis Ababa Bole International Airport expansion and potential privatization of state-linked enterprises such as Ethiopian Shipping Lines and Ethio Telecom, has further signaled the country’s gradual shift toward a more open investment regime. These reforms have been closely monitored by multilateral lenders, which view Ethiopia’s progress as a critical step toward boosting private capital participation in infrastructure development.

Looking ahead, Ethiopia’s investment outlook in 2025 remains cautiously optimistic, supported by its population size, strategic location, and industrial potential. However, challenges persist, including currency depreciation, debt pressures, and regional security risks, which could influence investor sentiment if not carefully managed. Nonetheless, analysts from Dabafinance and UNCTAD agree that Ethiopia’s ongoing structural reforms, particularly its focus on manufacturing and export diversification, position it well to sustain inflows in the medium term. As of 2025, Ethiopia stands out not only as one of Africa’s largest recipients of foreign direct equity investment, but also as a model of how targeted industrial policy and infrastructure-led development can attract long-term private capital, even amid global economic uncertainty.

1. Egypt

Egypt’s position as Africa’s top recipient of foreign direct equity inflows in 2024 and into 2025 is nothing short of extraordinary. As per UNCTAD’s World Investment Report 2025, the country recorded an estimated $46–46.6 billion in inward FDI in 2024, a figure that dwarfed the next highest recipients and reshaped continental investment rankings. What set Egypt apart was the concentration of several high-magnitude megaprojects, especially along the Ras El-Hekma / North Coast zone, backed by Gulf capital and global investors. These landmark initiatives included real estate, tourism, and coastal development projects that lifted equity inflows dramatically in a single year. In effect, Egypt’s extraordinary inflow pushes it to the top of the 2025 ranking, even as the comparators catch up over time.

The scale and nature of Egypt’s inflow are notable. Much of the capital came in the form of greenfield equity and project-level investment, rather than mere portfolio flows. It included massive real estate, tourism, infrastructure, and energy concessions, particularly funded by UAE, Saudi, and Qatari sovereign investors and sovereign wealth funds. The strategic location of Egypt, linking Africa, the Middle East and the Mediterranean, combined with government incentives and regulatory reforms, amplified its appeal for cross-border capital seeking regional platforms. Several industry sources point to coordinated auctions and bilateral funding deals in late 2023–2024 that matured in disbursement phases during 2024–25, thus concentrating large equity injections in that period.

Yet, while Egypt’s 2024 inflow data is headline-grabbing, the sustainability of such equity volumes is a more nuanced question. The risk lies in the dependence on large projects and external investor appetite: any slowdown in global capital, geopolitical shifts, or overruns in those mega-projects could lead to volatility in future inflows. Also, some portion of Egypt’s FDI may be accounted via layered corporate structures and reinvested earnings, complicating the direct attribution to fresh equity in the domestic economy. Nonetheless, the sheer size of the inflow demonstrates investor confidence in Egypt’s track record of macro stability, reform trajectory, and strategic positioning. It also forces analysts to reconsider how large amphibious coastal or tourism-led developments can reshape FDI rankings in a single cycle.

Looking into 2025, early indicators suggest Egypt may not replicate the same scale of inflows annually but its elevated baseline changes the competitive dynamic for Africa’s top FDI recipients. The government intends to continue its megadevelopment approach (e.g. new cities, special zones, energy investments) while deepening industrial and manufacturing incentives. If Egypt remains committed to regulatory clarity, infrastructure scaling, and balanced project pipelines, it is poised to stay at or near the top of Africa’s equity inflows table for years to come, even if future totals are less extreme than the record 2024 benchmark.

We welcome your feedback. Kindly direct any comments or observations regarding this article to our Editor-in-Chief at [email protected], with a copy to [email protected].