In Summary

- Nigeria leads Africa’s Islamic finance market, driven by surging deposits, sovereign sukuk programs, and a large, fintech-savvy Muslim population.

- Sudan, South Africa, Egypt, and Kenya show strong growth potential, supported by regulatory frameworks, market demand, and expanding Sharia-compliant banking products.

- Emerging markets like Ghana, Uganda, Tanzania, and Senegal are gaining traction, with rising investments, new legislation, and fintech innovations fueling sector expansion.

Deep Dive!!

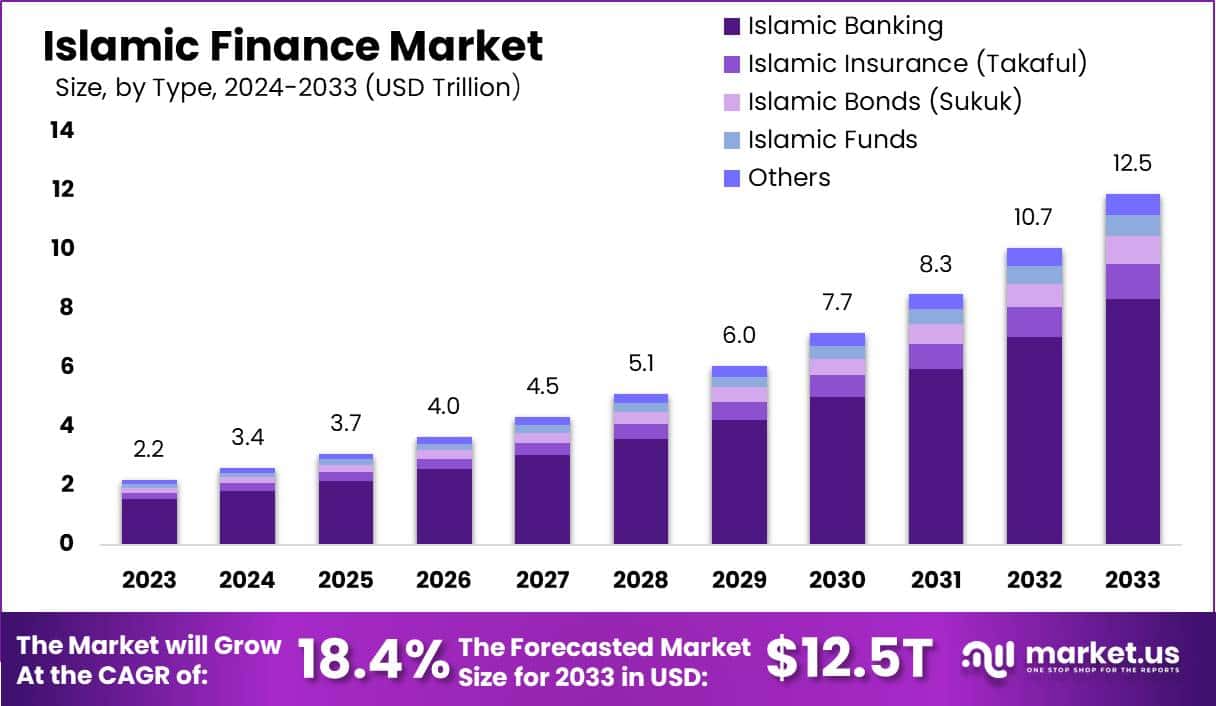

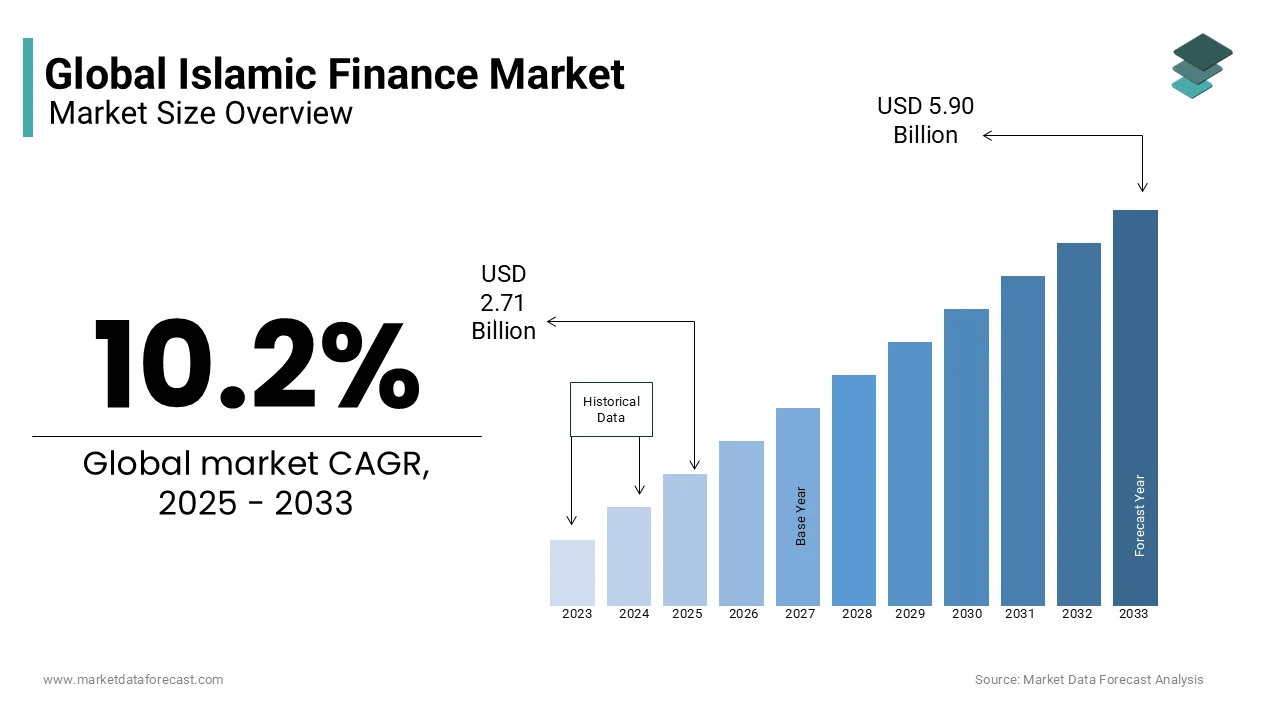

Monday, 10 November, 2025 – The Islamic finance sector in Africa has witnessed remarkable growth over the past decade, driven by rising demand for Sharia-compliant financial products, supportive regulatory reforms, and increasing investor interest in ethical and interest-free banking solutions. By 2025, several African nations have emerged as key players, leveraging sovereign sukuk programs, fintech innovations, and expanding banking infrastructures to capture both domestic and international capital. This dynamic landscape reflects the continent’s broader economic ambitions, including financial inclusion, sustainable development, and diversified sources of funding.

African countries are increasingly adopting policies and frameworks to foster the growth of Islamic finance, recognizing its potential to support infrastructure development, energy projects, trade financing, and small and medium-sized enterprises (SMEs). Governments are establishing clear regulatory guidelines, encouraging sukuk issuance, and promoting Islamic banking windows within conventional banks. Coupled with a rising population seeking ethical finance options, these measures have created fertile ground for both established markets, such as Nigeria and Sudan, and emerging players like Uganda and Ghana, to accelerate their growth trajectories.

The expansion of Islamic finance across the continent is further supported by technological innovation and regional collaboration. Fintech platforms are enabling broader access to Sharia-compliant accounts, mobile banking services, and digital investment instruments, while partnerships with international Islamic finance institutions are bringing capital, expertise, and credibility. As a result, Africa’s Islamic finance markets are not only expanding rapidly in size but are also becoming more sophisticated, inclusive, and resilient, positioning the continent as a significant player in the global Islamic finance ecosystem.

10. Ghana

Ghana has emerged as a promising frontier for Islamic finance in Africa, leveraging its growing economy, supportive regulatory framework, and expanding financial literacy among its population. By 2025, the country has made significant strides in developing Sharia-compliant banking products, including savings accounts, investment instruments, and small-scale financing solutions tailored to individual and business needs. Initiatives by the Bank of Ghana and partnerships with local and regional Islamic financial institutions have laid the groundwork for a structured and regulated Islamic finance sector, helping to attract both domestic and foreign investors.

A major driver of growth in Ghana’s Islamic finance market is the increasing demand for ethical and interest-free financial products among the Muslim population, which accounts for roughly 20 % of the country’s citizens. This demand has encouraged banks to launch dedicated Islamic banking windows and digital solutions that align with Sharia principles. In parallel, fintech innovations are supporting the sector by providing easier access to Sukuk investment opportunities, mobile-based Islamic banking, and automated compliance with Sharia rules, creating a more inclusive financial ecosystem that extends beyond traditional banking.

Despite these gains, Ghana faces challenges in scaling the sector and deepening market penetration. Limited awareness of Islamic finance among the wider population, a relatively small pool of trained Sharia-compliant finance professionals, and the need for more diverse product offerings pose hurdles for rapid expansion. Addressing these gaps through targeted education programs, professional training, and policy incentives will be crucial to transform Ghana’s Islamic finance market from a niche segment into a robust contributor to the country’s financial landscape. With sustained efforts, Ghana is well-positioned to solidify its role as a key emerging player in Africa’s Islamic finance growth story.

9. Uganda

Uganda has taken significant steps toward establishing a formal Islamic finance sector, positioning itself as a rising market in East Africa. With the enactment of legislation legalizing Islamic banking and the launch of its first full-fledged Islamic bank in March 2024, the country has created a regulatory and operational framework for Sharia-compliant financial services. These developments mark a critical turning point for Uganda’s financial landscape, enabling both individuals and businesses to access interest-free banking, ethical investment products, and Sharia-compliant financing solutions.

A key driver of growth is the untapped demand among Uganda’s Muslim population, which represents roughly 14 % of the national population. Although the market is currently small, early adopters of Islamic banking products are benefiting from access to ethical savings accounts, profit-sharing investment products, and trade financing. Fintech platforms are beginning to complement traditional banking, offering mobile-based Islamic financial services that increase reach into rural and underserved areas. These innovations provide the foundation for gradual expansion, while also building public awareness of Sharia-compliant financial alternatives.

Despite these promising developments, Uganda faces challenges in scaling its Islamic finance sector. The relatively modest Muslim population, limited human capital trained in Sharia-compliant finance, and the need for more diverse product offerings constrain rapid growth. To fully realize the potential of Islamic finance, Uganda will need to invest in professional training, enhance financial literacy, and incentivize partnerships between banks, fintechs, and regional Islamic finance hubs. With sustained effort, Uganda can transform from a nascent market into a dynamic participant in Africa’s growing Islamic finance landscape.

8. Tanzania

Tanzania has begun to establish itself as an emerging hub for Islamic finance in East Africa, leveraging recent regulatory reforms and a growing interest in Sharia-compliant financial products. With the introduction of sukuk regulations in 2024/25, the country has created a legal framework that allows both public and private entities to issue Islamic bonds, opening new avenues for infrastructure financing and long-term capital mobilization. These measures signal Tanzania’s commitment to integrating non-interest finance into its broader financial ecosystem and attracting investment from regional and international Islamic finance markets.

A major growth driver in Tanzania is the expanding demand for ethical and Sharia-compliant financial solutions, particularly in urban centers and among the Muslim population, which constitutes roughly 35 % of the country. Financial institutions are increasingly launching Islamic banking windows, mobile-based Islamic savings accounts, and investment products that comply with Sharia principles. This adoption is further supported by fintech innovations, which allow wider access to sukuk investments, profit-sharing accounts, and other non-interest financial instruments, bridging gaps in traditional banking coverage.

Despite the positive trajectory, Tanzania faces challenges in scaling its Islamic finance sector, including limited public awareness, a relatively small pool of qualified Sharia-compliant finance professionals, and the need for robust institutional capacity to support sukuk issuance and monitoring. Continued investment in financial literacy, professional training, and collaboration with regional Islamic finance hubs will be essential to unlock the market’s full potential. If successfully addressed, these measures position Tanzania as a promising player in Africa’s rapidly growing Islamic finance landscape.

7. Senegal

Senegal is steadily emerging as a promising market for Islamic finance in West Africa, driven by growing demand for Sharia-compliant financial products and supportive regulatory frameworks. In October 2025, the International Finance Corporation (IFC) announced up to US$40 million in Islamic financing for the Banque Islamique du Sénégal (BIS), signaling international confidence in the country’s potential and marking a landmark investment for the region. Although Islamic banking assets represented only about 8.3 % of total banking assets in 2024, this injection of capital is expected to accelerate market development and encourage further private sector participation.

A key factor underpinning growth in Senegal is the rising interest among the population in ethical, non-interest financial services, which cater not only to Muslims but also to individuals and businesses seeking alternative investment and financing options. Financial institutions are increasingly introducing Islamic banking windows, mobile banking solutions, and sukuk-based investment products to broaden access and appeal. These initiatives are further supported by fintech platforms that facilitate digital transactions, making it easier for both urban and rural customers to engage with Sharia-compliant financial services.

Despite its potential, Senegal faces challenges in expanding Islamic finance, including low overall market penetration, limited awareness among the broader population, and a shortage of trained professionals in Sharia-compliant finance. Addressing these gaps through targeted education programs, professional development, and regulatory incentives will be critical to unlocking growth. With strategic support from international partners and domestic policy measures, Senegal is well-positioned to evolve from a nascent market into a significant player in West Africa’s Islamic finance landscape.

6. Morocco

Morocco has emerged as a strategic hub for Islamic finance in North Africa, leveraging its well-developed banking sector, regulatory framework, and geographic position as a gateway to the continent. Casablanca, in particular, is being positioned as a center for Sharia-compliant financial services, attracting both regional and international investors interested in sukuk issuance, Islamic banking, and ethical investment products. While detailed growth rates are limited, the increasing number of institutions offering Islamic finance windows indicates a strong upward trajectory.

The country’s regulatory and institutional support has been a key enabler for this growth. Moroccan authorities have introduced specific guidelines for Islamic finance, ensuring compliance with Sharia principles while providing clarity and confidence for banks and investors. These regulations, combined with a growing population seeking ethical and interest-free financial products, have encouraged banks to expand their offerings beyond traditional windows, including Sharia-compliant savings, investment accounts, and project financing solutions.

Despite these advances, Morocco faces challenges in fully scaling the Islamic finance market, such as the need to increase public awareness and financial literacy regarding Sharia-compliant services and to cultivate a larger pool of trained professionals in Islamic finance. Partnerships with international Islamic finance institutions, fintech platforms, and regional training programs will be crucial to overcoming these gaps. With sustained policy support and market development, Morocco is poised to solidify its role as a leading player in Africa’s growing Islamic finance ecosystem.

5. Kenya

Kenya is rapidly positioning itself as a key player in East Africa’s Islamic finance market, driven by growing regulatory support and increased investor interest. The country is actively developing Islamic finance frameworks, including the establishment of sukuk regulations and dedicated Islamic banking windows, which provide Sharia-compliant alternatives for savings, investment, and project financing. This strategic focus aligns with Kenya’s broader economic goals of attracting sustainable infrastructure investment and tapping into ethical finance sources for energy and development projects.

A significant factor fueling Kenya’s Islamic finance growth is the rising demand among both corporate and individual clients for interest-free banking and investment products. Financial institutions are responding with mobile-based Islamic finance solutions, digital banking platforms, and profit-sharing investment accounts, expanding access to Sharia-compliant services across urban and rural areas. These offerings are not only attracting local clients but are also drawing regional and international investors seeking ethical financing options aligned with sustainable development goals.

Despite this momentum, Kenya faces challenges in scaling the market, including limited public awareness of Islamic finance, a shortage of professionals trained in Sharia-compliant banking, and the need to diversify product offerings beyond basic banking services. Addressing these gaps through education, professional training, and partnerships with global Islamic finance institutions will be key to realizing the country’s full potential. With continued regulatory support and market innovation, Kenya is on track to become a major hub for Islamic finance in Africa.

4. Egypt

Egypt has firmly established itself as a front-runner in North Africa’s Islamic finance market, leveraging a combination of regulatory innovation, economic scale, and strategic sectoral initiatives. The country has issued major Islamic finance instruments, including sovereign and corporate sukuk, which have attracted both domestic and international investors. By embedding Sharia-compliant financing into critical areas such as food security, infrastructure, and energy projects, Egypt is demonstrating the versatility and strategic value of Islamic finance in supporting national development objectives.

A key driver of Egypt’s success is its integrated approach to financial innovation, combining conventional and Sharia-compliant finance to serve diverse market needs. Islamic banks and windows have expanded rapidly, offering products ranging from savings and investment accounts to trade financing and project-based sukuk. In parallel, fintech solutions are supporting digital adoption, enabling wider access to Islamic finance services, particularly among younger, tech-savvy populations and SMEs seeking interest-free financial instruments.

Despite these achievements, Egypt faces challenges in ensuring inclusive growth and market depth. While the market is robust at the institutional level, broader public awareness, financial literacy, and the availability of a trained Islamic finance workforce remain areas for improvement. Strengthening education, professional certification, and outreach programs will be essential for deepening the market and maintaining Egypt’s leadership role. With continued regulatory support and innovation, Egypt is set to remain a cornerstone of Africa’s Islamic finance expansion.

3. South Africa

South Africa’s Islamic finance market is gaining momentum, building from a relatively low base but demonstrating strong growth potential. With projections indicating a compound annual growth rate (CAGR) of approximately 11.2% for its Islamic finance segment, the country is beginning to attract both domestic and international investors interested in Sharia-compliant banking, investment, and sukuk instruments. This expansion reflects increasing awareness among consumers and businesses of ethical, interest-free financial solutions that align with Islamic principles.

A significant factor driving this growth is South Africa’s well-established financial infrastructure and skilled workforce, which provide the necessary foundation for a sophisticated Islamic finance market. Leading banks have begun offering Islamic banking windows, profit-sharing investment accounts, and sukuk-based financing, while fintech platforms are facilitating broader access to Sharia-compliant products. These developments are enabling both retail clients and institutional investors to participate in ethical finance options, creating opportunities for deeper market penetration and innovation within the financial sector.

Despite these gains, South Africa faces challenges in scaling the market, including limited public awareness, a relatively small pool of professionals trained in Sharia-compliant finance, and the need for more diverse product offerings. Expanding education programs, professional certification, and regulatory clarity will be crucial for sustaining growth. If successfully addressed, South Africa’s Islamic finance sector has the potential to become a major contributor to the country’s broader financial landscape and a model for emerging markets across Africa.

2. Sudan

Sudan has long been a cornerstone of Islamic finance in Africa, with a banking system predominantly structured around Sharia-compliant principles. Islamic banks in the country hold a substantial share of total banking assets, and the market is among the largest and fastest-growing in sub-Saharan Africa. This dominance reflects both historical precedence and a regulatory environment fully aligned with Islamic finance principles, allowing Sudan to serve as a mature model for Sharia-compliant banking on the continent.

The country’s advanced Islamic banking ecosystem encompasses a broad range of products, from profit-sharing investment accounts and murabaha financing to sukuk issuance and Takaful insurance. Sudan’s financial institutions have leveraged both domestic demand and international partnerships to expand their reach, attracting capital from regional and global investors seeking ethical and interest-free investment opportunities. The prevalence of Islamic banking in Sudan provides a foundation for supporting key sectors such as trade, agriculture, and infrastructure, integrating Sharia-compliant finance into the broader economy.

Despite its leading position, Sudan faces challenges in sustaining growth and diversification. Economic volatility, limited technological adoption in some banking services, and gaps in financial inclusion constrain market expansion. Continued investment in digital platforms, financial literacy programs, and regulatory enhancements will be crucial to maintain Sudan’s competitive edge. With these measures, Sudan is well-positioned to remain a central player in Africa’s Islamic finance landscape while serving as a benchmark for emerging markets in the region.

1. Nigeria

Nigeria stands at the forefront of Africa’s Islamic finance market, demonstrating remarkable dynamism and rapid growth. Deposits in Nigerian Islamic banks surged by approximately 92.5%, reaching NGN 971.53 billion in 2023, up from NGN 504.6 billion in 2022. This significant expansion underscores growing public confidence in Sharia-compliant financial products and the increasing adoption of ethical, interest-free banking solutions across both retail and corporate segments.

A key driver of Nigeria’s leadership is its large and diverse Muslim population, which creates substantial domestic demand for Islamic banking, sukuk issuance, and other Sharia-compliant financial instruments. The country’s sovereign sukuk programme has further enhanced investor confidence, providing a stable and regulated platform for both local and international investment. Additionally, Nigeria’s thriving fintech ecosystem supports innovative delivery channels for Islamic finance, including mobile banking, digital wallets, and online investment platforms, extending access to previously underserved populations.

Despite its impressive growth, Nigeria faces challenges in ensuring depth and inclusivity in its Islamic finance sector. Expanding financial literacy, developing specialized Sharia-compliant financial professionals, and increasing product diversification will be essential to sustain momentum. With strategic regulatory support, continued fintech innovation, and robust investor participation, Nigeria is poised to maintain its position as Africa’s leading Islamic finance market and a benchmark for emerging economies across the continent.

We welcome your feedback. Kindly direct any comments or observations regarding this article to our Editor-in-Chief at [email protected], with a copy to [email protected].