In Summary

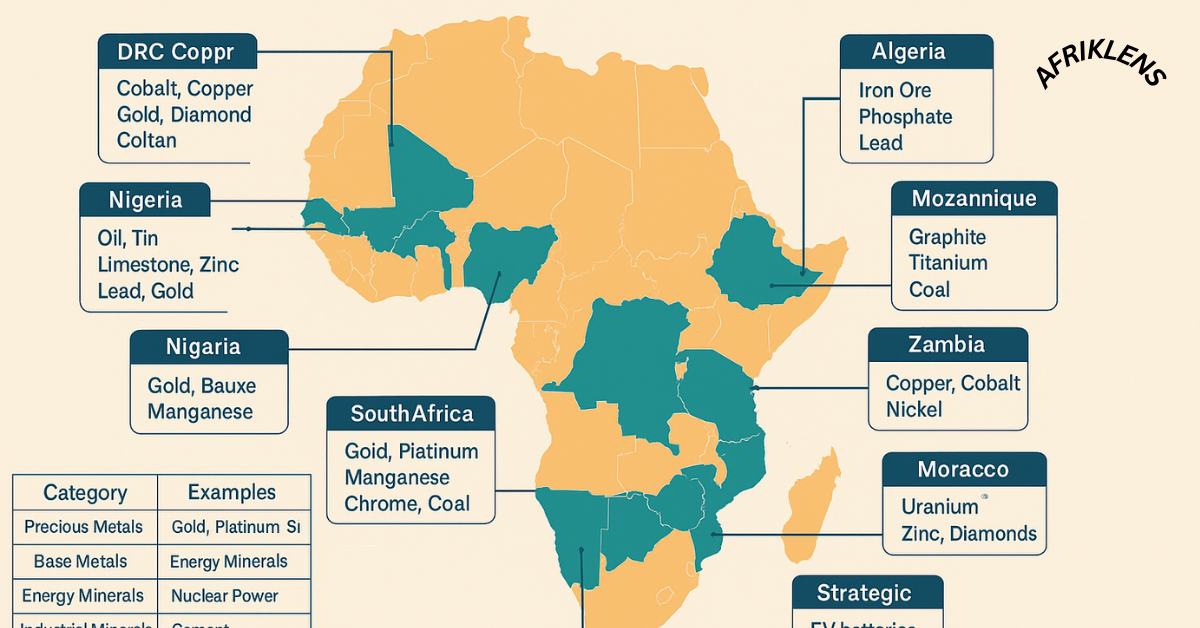

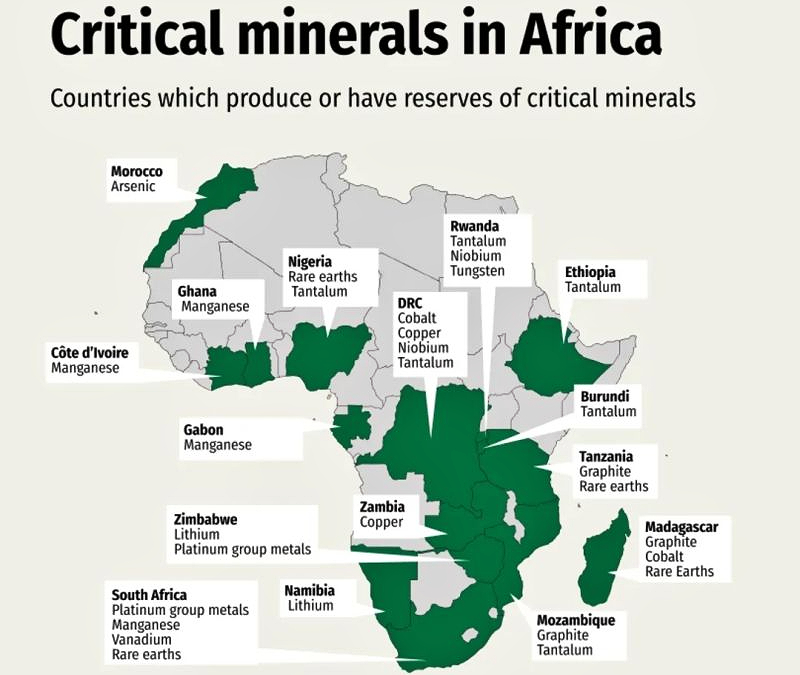

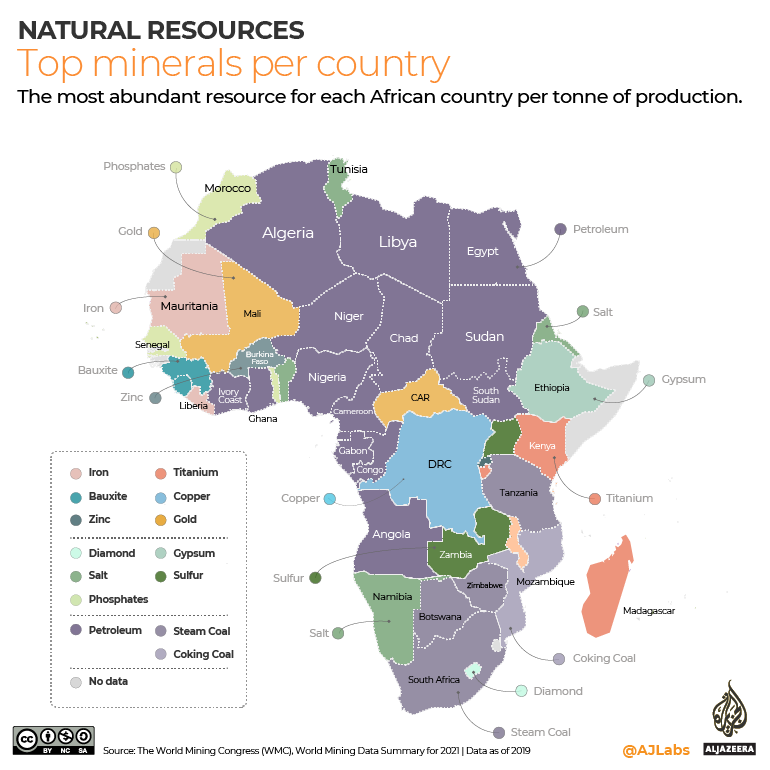

- The continent hosts vast and diverse mineral reserves, including cobalt, copper, lithium, platinum, gold, bauxite, uranium, diamonds, and industrial minerals, making it a key player in global commodity markets.

- The leading nations by mineral reserves in 2025 are DRC, South Africa, Zimbabwe, Guinea, Zambia, Namibia, Angola, Mali, Botswana, and Nigeria, each contributing significantly to production and export revenues.

- Mining continues to be a major driver of national economies, generating substantial revenue, foreign exchange, and investment opportunities, while influencing industrialization and strategic development across the continent.

Deep Dive!!

Africa is home to some of the world’s richest and most diverse mineral reserves, spanning critical metals, precious stones, and industrial minerals. In 2025, the continent continues to play a pivotal role in supplying global markets with essential resources that underpin modern technologies, renewable energy, and industrial development. African nations are not only endowed with vast deposits but are increasingly leveraging these resources to drive economic growth, foreign investment, and regional development.

The top ten African countries by mineral reserves exemplify the continent’s strategic importance in the global mining sector. The Democratic Republic of Congo leads with dominant cobalt, copper, and lithium reserves, feeding the electric vehicle and battery supply chains worldwide. South Africa maintains its historical edge in platinum, gold, manganese, and chromium production, while Zimbabwe is emerging as Africa’s lithium powerhouse alongside its significant platinum and gold resources. Other countries, including Guinea with its bauxite and iron ore, Zambia with copper, Namibia with uranium, Angola with diamonds and base metals, Mali with gold, Botswana with diamonds and base metals, and Nigeria with tin, limestone, and coal, collectively highlight the continent’s immense resource potential and its relevance to global commodity markets.

These mineral reserves not only provide raw materials but also underpin economic strategies for revenue generation, industrialization, and infrastructure development across Africa. In 2024 and 2025, mining revenues from these nations continue to contribute significantly to national GDPs, government budgets, and export earnings, reflecting both the value and volatility of global commodity markets. This article provides a detailed overview of these ten nations, analyzing their key mineral deposits, production trends, and revenue contributions, offering insights for investors, policymakers, and industry stakeholders seeking to understand where the African mining sector is headed in 2025.

10. Nigeria

Nigeria is endowed with a diverse range of mineral resources, including significant deposits of tin, limestone, and coal. The country has substantial tin reserves in the Jos Plateau, limestone deposits across 14 states, and coal resources in the Middle Belt and southeastern regions. Despite these abundant resources, the mining sector has historically been underdeveloped, contributing less than 1% to Nigeria’s GDP. This underutilization is attributed to factors such as inadequate infrastructure, regulatory challenges, and a focus on oil exports.

In 2024, Nigeria’s solid minerals sector generated approximately ₦38 billion (about $48 million) in revenue, primarily from royalties and fees associated with tin, limestone, and coal. This marked a significant increase from previous years, reflecting improved enforcement of mining regulations and efforts to formalize the sector. The government’s initiatives, such as the establishment of a Mining Cadastre Office and the revocation of dormant mining titles, have contributed to this positive trend.

The Nigerian government has recognized the potential of the mining sector as a catalyst for economic diversification and has implemented several reforms to attract investment. These include the introduction of policies that mandate local processing of minerals, offering incentives like tax exemptions and simplified licensing procedures. Additionally, Nigeria has engaged in international partnerships, such as the agreement with South Africa to enhance mining capabilities through joint geological mapping and data sharing.

Despite these efforts, challenges remain, including illegal mining activities, inadequate infrastructure, and security concerns in certain regions. The government has taken steps to address these issues by establishing a special security unit to combat illegal mining and by investing in infrastructure development. If these challenges are effectively managed, Nigeria’s mining sector has the potential to significantly contribute to the country’s economic growth and development in the coming years.

9. Botswana

Botswana continues to be a dominant force in Africa’s mining sector, renowned for its substantial diamond reserves. In 2025, the country ranks as the second-largest global producer of diamonds by volume, with an estimated output of 25.1 million carats, valued at approximately $3.3 billion. The Jwaneng and Orapa mines, operated by Debswana, a joint venture between the government of Botswana and De Beers, are among the world’s richest diamond mines, contributing significantly to the nation’s mineral wealth.

Beyond diamonds, Botswana is making strides in diversifying its mineral portfolio. The Selebi North and Selebi Main deposits, previously mined for nickel and copper, are undergoing exploration by NexMetals Mining Corp. Initial drilling results have indicated substantial reserves, with inferred resources of 18.9 million tonnes at 0.88% nickel and 1.69% copper in the Main deposit. These findings position Botswana as a potential future hub for base metals, aligning with global trends towards critical mineral development.

Mineral exports remain a cornerstone of Botswana’s economy, though recent challenges have impacted revenues. In the 2024/2025 fiscal year, mineral revenues are projected to contribute approximately 25.1% to the national budget, a decline from previous years due to reduced diamond sales. The downturn in the diamond market has been attributed to factors such as increased competition from lab-grown diamonds and decreased demand from key markets like China.

In response to these challenges, Botswana has taken proactive measures to stabilize and enhance its mining sector. A significant development is the new 10-year diamond sales agreement with De Beers, finalized in February 2025. This agreement increases Botswana’s share of diamond sales through Debswana from 25% to 30% for the first five years, with an option to extend to 50% in the subsequent period. Additionally, the government has been actively pursuing diversification strategies, including investments in base metals and uranium, to reduce dependency on diamond revenues and ensure long-term economic stability.

Looking ahead, Botswana is positioning itself to capitalize on emerging opportunities in the mining sector. The government’s focus on critical minerals, such as nickel and copper, is evident in the support for exploration projects like those at the Selebi deposits. Furthermore, the Letlhakane Uranium Project, being advanced by Lotus Resources, has confirmed economic viability with potential annual production of up to 3 million pounds of uranium, marking another step in Botswana’s diversification efforts.

Despite the current economic challenges, Botswana’s commitment to sustainable mining practices, strategic partnerships, and infrastructure development positions the country to maintain its status as a leading mineral producer in Africa. The ongoing reforms and investments in the mining sector are expected to yield positive outcomes, fostering economic resilience and growth in the coming years.

8. Mali

Mali stands as Africa’s third-largest gold producer, with substantial reserves and a rich mining history. As of December 2024, the country reported gold reserves of 800 metric tons, maintaining a steady figure over the previous year. In 2024, Mali’s industrial gold production reached 70,000 kg (approximately 70 metric tons), marking a 23% decline from the previous year. This downturn was primarily due to operational disruptions at major mining sites, notably the Loulo-Gounkoto complex, which accounted for about 15% of Barrick Gold’s global output.

The Loulo-Gounkoto complex, operated by Barrick Gold, experienced a suspension in early 2025 following disputes between the Malian government and the company over tax issues and a new mining code. The government seized gold stockpiles and blocked exports, leading to a halt in production from January to July. Although operations resumed in July under a government-appointed administrator, output remained at only 25% of normal levels due to limited access to spare parts.

Despite the production challenges, gold exports remain a significant contributor to Mali’s economy. In 2024, state revenue from gold mining companies increased by 52.5% compared to the previous year, driven by higher tax collections and dividend payments following the implementation of a new mining code. However, the decline in production in 2025 poses risks to sustaining this revenue growth.

The government’s strategy to enhance state control over the mining sector includes initiatives such as the partial lifting of the mining permit suspension in March 2025, allowing for the renewal and transfer of existing permits while maintaining strict regulatory oversight . Additionally, Mali has completed the takeover of the Yatela and Morila gold mines abandoned by foreign companies, aiming to revitalize these assets under national ownership.

Mali’s gold mining sector faces several challenges, including political tensions with international mining companies, security concerns, and the need for infrastructure development. The suspension of operations at major mines like Loulo-Gounkoto has underscored the vulnerability of the sector to regulatory changes and geopolitical factors. Furthermore, artisanal mining, which contributes approximately 30 tons of gold annually, has been impacted by safety issues and militant activities, leading to increased scrutiny and regulatory measures.

Looking ahead, Mali’s mining sector will need to balance state control with attracting foreign investment to ensure sustainable growth. The government’s efforts to modernize the mining code and assert greater sovereignty over mineral resources reflect a broader trend of resource nationalism in the region. However, the success of these initiatives will depend on the country’s ability to navigate complex political dynamics and maintain investor confidence.

7. Angola

Angola is a significant player in Africa’s mining sector, with substantial mineral reserves that contribute to its economic growth. The country is renowned for its diamond resources, holding over 732 million carats in untapped reserves, potentially valued at more than $140 billion at an average price of $200 per carat. In 2025, Angola’s diamond production is projected to reach 14.8 million carats, generating an estimated $2.1 billion in revenue. The Luele (Luaxe) mine, inaugurated in November 2023, is expected to produce 628 million carats over its 60-year lifespan, with an initial annual processing capacity of 4 million metric tons of ore, set to increase to 12 million tons.

Beyond diamonds, Angola possesses significant iron ore and copper deposits. The Cassinga Iron Ore Project in Huila Province is one of Africa’s largest iron ore reserves, with estimated reserves of approximately 1 billion metric tons at a grade of 60% Fe. In the copper sector, the Mavoio-Tetelo Copper Project in northern Angola, developed by Chinese firm Shining Star, is set to commence production in 2025, with an anticipated annual output of 300,000 tons.These projects underscore Angola’s potential to become a significant exporter of base metals.

In 2024, Angola’s diamond industry generated approximately $1.4 billion in revenue. The government projects this figure to rise to $2.1 billion in 2025, reflecting a 50% increase in revenue. This growth is attributed to the expansion of mining operations and the development of new projects like the Luele mine. The iron ore and copper sectors are also poised to contribute significantly to the country’s mining revenue in the coming years, with the Mavoio-Tetelo Copper Project expected to add substantial output to Angola’s copper production.

Angola is investing heavily in infrastructure to support its mining sector. The Lobito Corridor, a key railway and port infrastructure project, aims to facilitate the transportation of minerals from the interior to the Atlantic coast, enhancing export capabilities. Additionally, the government is focusing on developing processing facilities for iron ore and copper to add value to its mineral exports. These initiatives are part of Angola’s broader strategy to diversify its economy and reduce dependence on oil exports.

Despite the promising outlook, Angola’s mining sector faces challenges, including the need for significant investment in infrastructure and technology. The country is also working to improve governance and transparency in the mining industry to attract foreign investment and ensure sustainable development. With ongoing reforms and strategic investments, Angola is positioning itself as a key player in Africa’s mining industry, with the potential to become a leading exporter of diamonds, iron ore, and copper.

6. Namibia

Namibia is a significant player in Africa’s mining sector, renowned for its substantial uranium, diamond, and zinc reserves. The country ranks as the third-largest global producer of uranium, contributing approximately 11–12% of the world’s mined supply in 2024. Key uranium operations include the Husab, Rössing, and Langer Heinrich mines, which collectively bolster Namibia’s position in the global nuclear energy market.

In the diamond sector, Namibia produced about 2.2 million carats in 2024, accounting for approximately 9% of De Beers’ global output. The country’s diamonds are renowned for their high quality, with an average value of $417 per carat, placing Namibia at the forefront of the global diamond industry.

Namibia also possesses significant zinc reserves, primarily concentrated in the Rosh Pinah mine. In 2024, Rosh Pinah processed 650,000 tonnes of ore, producing 87 million pounds of zinc, 14 million pounds of lead, and 244,000 ounces of silver. The ongoing expansion project at Rosh Pinah aims to nearly double throughput to 1.3 million tonnes per year, enhancing Namibia’s position in the global zinc market.

In 2024, Namibia’s mining sector generated a total revenue of 51.4 billion Namibian dollars (approximately $2.89 billion USD), representing a marginal 0.4% decrease from the previous year. Despite this slight downturn, the sector remains a cornerstone of Namibia’s economy.

The uranium sector continues to be a major contributor to export revenues, driven by consistent production levels and global demand for nuclear energy. Similarly, the diamond industry, despite facing challenges such as synthetic diamond competition and market fluctuations, maintains its status as a significant revenue generator due to the high value of Namibian diamonds.

Zinc exports, particularly from the Rosh Pinah mine, have shown promising growth. The expansion project at Rosh Pinah is expected to further boost zinc production and exports, contributing positively to Namibia’s mining revenue in the coming years.

Looking ahead, Namibia’s mining sector is poised for growth, with ongoing investments in exploration, infrastructure, and technological advancements. The government’s commitment to sustainable mining practices and value addition initiatives, such as the development of downstream uranium processing capabilities, aims to enhance the sector’s contribution to the national economy and ensure long-term prosperity.

5. Zambia

Zambia is a prominent player in Africa’s mining sector, renowned for its substantial copper reserves. The country is home to some of the world’s richest copper deposits, notably in the Copperbelt region. In 2024, Zambia’s copper production reached approximately 820,670 metric tons, marking a 12% increase from the previous year. This growth was attributed to the recovery of key mines, such as Barrick Gold’s Lumwana and Vedanta Resources’ Konkola Copper Mines, alongside the resumption of operations at Mopani Copper Mines, recently acquired by International Resources Holding of the UAE.

The country’s major copper mines include the Kansanshi and Sentinel mines, both operated by First Quantum Minerals. Kansanshi, located in the North-Western Province, is one of Zambia’s largest copper mines, with estimated reserves of 727 million tonnes of ore grading 0.86% copper. Sentinel mine, also in the North-Western Province, has a reserve of 1.03 billion tonnes of ore with a copper content of 0.51%, expected to yield about 300,000 tons of copper concentrate annually over a 15-year lifespan. These mines play a crucial role in Zambia’s position as Africa’s second-largest copper producer.

Copper remains Zambia’s primary export, generating over 70% of the country’s export earnings and approximately 44% of government revenue. In 2024, copper export earnings amounted to US$7.49 billion, reflecting the metal’s critical role in the nation’s economy. The government has set an ambitious target to increase copper production to 3 million metric tons annually by 2031, positioning Zambia among the top three global copper producers.

To achieve this goal, Zambia is attracting significant foreign investment. Notably, KoBold Metals, backed by investors including Bill Gates, plans to invest $2.3 billion in the Mingomba copper project, aiming to produce over 300,000 metric tons per year, making it the country’s largest copper operation. Additionally, Barrick Gold is undertaking a $2 billion expansion of the Lumwana mine, expected to double its output and extend its operational life until 2057.

Despite the optimistic outlook, Zambia’s mining sector faces challenges, including environmental concerns. In early 2025, a catastrophic tailings dam failure at a Chinese-owned copper mine released approximately 50 million liters of toxic waste into the Kafue River, severely impacting aquatic life and water supplies for over half of Zambia’s population. The incident has prompted the government to implement stricter environmental regulations and oversight to prevent future occurrences.

To bolster the mining sector’s growth, Zambia has introduced several initiatives. The Zambia Integrated Mining Information System, launched in February 2025, aims to enhance efficiency and transparency in mining license management, facilitating faster exploration approvals. Additionally, the government has been proactive in repossessing non-compliant mining licenses, reallocating them to new investors to accelerate exploration efforts.

These strategic measures, combined with substantial investments in infrastructure and capacity expansion, are expected to propel Zambia’s mining sector toward its production targets, contributing significantly to the nation’s economic development.

4. Guinea

Guinea stands as a global leader in mineral reserves, particularly in bauxite, iron ore, and gold. The country holds approximately 7.4 billion metric tons of bauxite, accounting for about 26% of the world’s known reserves, making it the largest bauxite producer globally. In 2025, Guinea’s bauxite exports reached a record 99.8 million metric tons, marking a 36% increase from the previous year. The bauxite is primarily exported to China, which imports roughly 60% of its bauxite from Guinea, underscoring the country’s pivotal role in the global aluminum supply chain.

In addition to bauxite, Guinea possesses significant iron ore reserves, with the Simandou mine being one of the world’s largest untapped high-grade iron ore deposits. The project, located in the Nzérékoré Region, holds estimated reserves of 2.4 billion metric tons of ore with a grade of 65% iron content. Development of the Simandou project has faced delays due to political and legal disputes; however, shipments are expected to commence in late 2025. This development is anticipated to significantly impact global iron ore markets, particularly in China, the world’s largest consumer of iron ore.

Guinea’s mining sector also includes gold, with the Lefa mine being one of the country’s largest producers. While gold production figures for 2025 are not yet available, the sector has historically contributed to the country’s export revenues. The government has been focusing on increasing transparency and efficiency in the mining sector to attract more investment and ensure sustainable development.

The mining sector is a cornerstone of Guinea’s economy, accounting for over 90% of its export earnings and contributing significantly to its GDP. In the first half of 2025, Guinea’s bauxite exports surged to a record 99.8 million metric tons, driven by robust Chinese demand. This increase in exports is expected to bolster the country’s foreign exchange reserves and provide the government with additional revenue to fund infrastructure and development projects.

The Simandou iron ore project, once operational, is projected to produce up to 120 million metric tons of iron ore annually, potentially generating substantial revenue for the country. The development of this project is expected to create jobs, stimulate economic growth, and enhance Guinea’s position in the global mining industry.

To further capitalize on its mineral wealth, Guinea has been implementing policies aimed at increasing local beneficiation and value addition. The government is encouraging foreign investors to establish processing facilities within the country, which would create additional employment opportunities and increase the value derived from its mineral resources.

Despite the challenges posed by political instability and infrastructure deficits, Guinea’s mining sector continues to attract significant foreign investment. The government’s commitment to improving the business environment and ensuring the sustainable development of its mineral resources is expected to yield long-term economic benefits for the country.

3. Zimbabwe

Zimbabwe stands as a significant player in Africa’s mining sector, boasting the continent’s largest known lithium reserves and substantial deposits of platinum, gold, and chromium. The country’s lithium resources are estimated to be among the top five globally, with the Bikita mine alone holding approximately 10.8 million tonnes of lithium ore grading 1.4% lithium. In 2024, Zimbabwe produced about 122,000 metric tons of lithium material, nearly doubling its output from the previous year. This surge in production underscores the nation’s pivotal role in the global supply chain for electric vehicle (EV) batteries and renewable energy storage.

In addition to lithium, Zimbabwe is a leading producer of platinum, with key mines such as Zimplats and Mimosa contributing significantly to its output. However, in 2025, platinum production faced challenges due to declining global prices, leading to a projected decrease in output to approximately 17,540 kg. Gold remains a cornerstone of Zimbabwe’s mining industry, with exports reaching US$2.5 billion in 2024, marking a 9% increase from the previous year. The country’s gold sector is set for further growth, with output projected to rise from 38,454 kg in 2024 to 43,390 kg in 2025.

Zimbabwe also possesses significant chromium reserves, primarily located along the Great Dyke. The country is among the world’s top producers of chromite ore, which is essential for the production of ferrochrome, a key component in stainless steel manufacturing. In 2024, Zimbabwe’s chromite production contributed to its position as a major player in the global ferrochrome industry.

The mining sector is a cornerstone of Zimbabwe’s economy, accounting for over 60% of the country’s total export earnings in 2024. Gold exports alone generated approximately US$2.5 billion, while platinum contributed around US$1.8 billion. Lithium, an emerging sector, saw significant growth, with exports reaching US$210 million, fueled by increasing global demand for battery minerals. Coal production, although primarily for domestic use, contributed to the country’s energy security and accounted for approximately US$150 million in revenue.

In 2025, Zimbabwe’s total mineral revenue is forecasted to reach US$6.2 billion, up from US$5.9 billion in 2024. This growth is attributed to a rebound in gold production and sustained demand for lithium, despite challenges in other sectors. The government’s strategic focus on value addition and beneficiation, particularly in the lithium sector, aims to enhance revenue streams and reduce dependency on raw mineral exports.

However, the mining sector faces challenges, including high production costs, energy shortages, and policy uncertainties. In 2025, miners anticipate a decline in profits due to these factors, with production costs projected to rise by an average of 8% and energy requirements expected to increase to 800 megawatts per day. Despite these challenges, the sector remains a vital source of foreign currency and employment, underscoring its importance to Zimbabwe’s economic stability.

In response to global trends and to retain more value domestically, Zimbabwe has announced plans to ban the export of lithium concentrates starting in January 2027. This policy aims to encourage local processing and beneficiation, aligning with the government’s broader economic strategy to enhance the mining sector’s contribution to national development.

2. South Africa

South Africa continues to be a global leader in mineral reserves, particularly in platinum group metals (PGMs), gold, manganese, and chromium. As of 2025, the country holds approximately 70% of the world’s known platinum reserves, making it the dominant global supplier of this critical metal. In 2024, South Africa produced 120,000 kilograms of platinum, accounting for over 75% of global production. The Bushveld Complex, a vast geological formation, remains the primary source of these resources.

Gold production in South Africa has seen a significant decline over the past decades. From a peak of 1,000 metric tons in 1970, output dwindled to just 90 metric tons in 2024. Despite this downturn, the country still holds substantial gold reserves, estimated at 125.47 tonnes as of the second quarter of 2025.

South Africa is also the world’s largest producer of manganese, with reserves estimated at 560 million metric tons, accounting for about 70% of global resources.In 2024, the country produced 7.4 million metric tons of manganese, reinforcing its position as a key player in the global supply chain for this essential metal.

Regarding chromium, South Africa holds approximately 200 million metric tons of reserves, making it the world’s leading producer and exporter of chromite ore. In 2024, the country exported a record 20.5 million metric tons of chrome concentrate, primarily to China, underscoring its pivotal role in the global ferrochrome industry.

Mineral exports remain a cornerstone of South Africa’s economy. In the fiscal year 2024/2025, the mining sector contributed approximately R35 billion in royalties and taxes, accounting for about 14% of corporate taxes and providing substantial personal income tax revenues from employees.

Despite the challenges faced by the mining sector, including policy uncertainties and infrastructure issues, South Africa’s mineral exports continue to be a significant source of foreign exchange. The government’s efforts to diversify funding sources, such as the $500 million foreign currency financing initiative launched in July 2025, aim to bolster the country’s economic resilience and attract global investment.

The mining sector’s performance in 2025 has been mixed. While platinum production faced a decline due to operational challenges, the manganese and chromium sectors have shown resilience, maintaining their global dominance. The government’s proposed 25% export levy on chrome ore aims to encourage domestic beneficiation and address the challenges faced by the ferrochrome industry.

Looking forward, South Africa’s mining sector faces both opportunities and challenges. The global demand for critical minerals, such as PGMs and manganese, presents avenues for growth. However, addressing infrastructure bottlenecks, policy uncertainties, and labor-related issues will be crucial to sustaining the sector’s contribution to the national economy.

1. Democratic Republic of Congo (DRC)

The Democratic Republic of Congo (DRC) stands as a global powerhouse in mineral reserves, particularly in cobalt, copper, and lithium. The DRC is estimated to hold approximately 70% of the world’s cobalt reserves, making it the leading global source of this critical metal essential for electric vehicle (EV) batteries and renewable energy storage. In 2024, the country produced 220,000 metric tons of cobalt, accounting for about 84% of global production.

Copper is another cornerstone of the DRC’s mining sector. With 80 million metric tons in reserves, the country ranks fourth globally in copper reserves. In 2024, DRC’s copper production reached 3.3 million metric tons, representing 11% of global output. The Kamoa-Kakula project, operated by Ivanhoe Mines, produced a record 437,061 tons in 2024 and aims to increase output to between 520,000 and 580,000 tons in 2025.

Lithium, a vital component for EV batteries, has also garnered significant attention in the DRC. The Manono project, located in southeastern DRC, is one of the world’s largest undeveloped hard rock lithium deposits. Preliminary surveys in 2024 identified 2.62 million tons of lithium oxide at an average grade of 1.5%, equivalent to approximately 6.47 million tons of lithium carbonate. Companies like KoBold Metals and Zijin Mining are actively involved in the development of this project.

The mining sector is a significant contributor to the DRC’s economy. In 2024, the country’s economy grew by 6.5%, driven by a 12.8% expansion in the extractive sector, particularly copper and cobalt production. However, a state audit revealed that mining companies operating in the DRC underreported $16.8 billion in revenue between 2018 and 2023, potentially reducing funds for the government and local communities.

In response to fluctuating cobalt prices, the DRC government implemented a temporary export ban in early 2025, followed by a quota system starting October 16, 2025. Under this system, cobalt exports are capped at 18,125 metric tons for the remainder of 2025, with annual limits of 96,600 metric tons for 2026 and 2027. This move aims to control global supply, improve price stability, and address concerns over traceability stemming from the country’s artisanal mining sector.

The DRC’s mineral wealth continues to attract significant foreign investment. In 2024, mining companies invested $130.7 million in exploration activities in the DRC, making it the leading destination for mining exploration investment in Africa. As the global demand for critical minerals like cobalt, copper, and lithium grows, the DRC’s role as a key supplier is poised to expand, offering substantial opportunities for investors and stakeholders in the energy transition sector.